YOUR IMAGINATION IS HAVING PUPPIES

TSLA short position initiated

The great Canadian poet Gord Downie once sang, "your imagination is having puppies". As I have stared at the price action of Tesla over the past few days, I could think of no better way to describe the optimistic pipe dreams Tesla bulls are baking into the price of this stock.

I have fielded a few questions asking what I thought about the action. Luckily for me, I had taken the ticker off my screen recently, so I have tried to ignore it. But I definitely have an opinion about what is going on.

Before I tell you my theory, let me dispel the most common one. Many people are claiming this is the biggest short squeeze in history. Although short interest was at one point extremely high for this stock, over the past year, it has steadily declined.

You might run across all sorts of scary charts highlighting a massively growing notional amount of Tesla shares sold short. Ignore that. It means little with the stock exploding in value. What matters is shares sold short. And that number has been steadily declining. When you combine the fact that there are a few convertible bond issues that are now deeply in the money (and therefore likely have fully hedged short positions against them), the amount of short sellers betting on this company falling has been dramatically decreasing. No doubt there are still some left. But they are not driving the run higher. If they were, the borrow rates would be increasing, and instead they are falling. Nope, the shorts are not the culprit.

Next most cited reason for the rise in Tesla's stock price is short gamma from the market makers. Now I buy this theory - to some extent. Tesla has definitely become a retail (and institutional) trading darling. On the whole, clients are buying options from market makers, creating a negative feedback loop both ways. As the stock rises, the market makers find themselves short more stock, so they need to buy more. As it falls, they need to short it again. The massive negative gamma dealer position is definitely exacerbating stock price movement (and it will happen both ways - make no mistake about it).

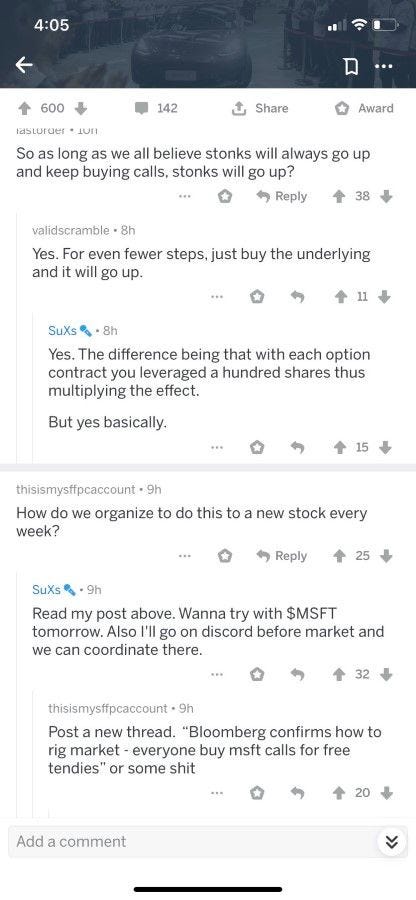

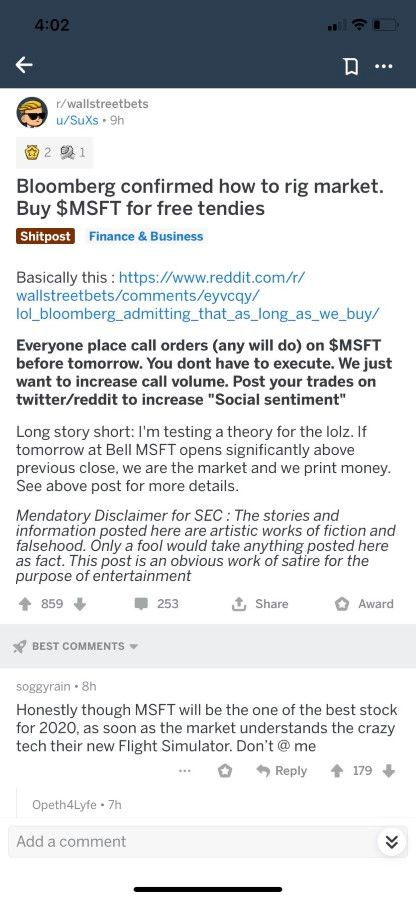

The most hilarious part of this phenomenon? As my pal, Bloomberg reporter Luke Kawa recently noted, in the reddit forums investors have clued into this reality and are trying to orchestrate bull raids on other stocks (which is highly illegal, but then again the SEC didn't seem to shut down Elon for all his infractions, so I guess manipulation on the upside isn't manipulation but instead just good trading).

The reason the reddit thread is feeling so emboldened? We have entered that point in a speculative mania when investors are posting pictures of their massive balances. I can distinctly remember the same happening in bitcoin, and now it's transitioned to the TSLA option trading community.

You see that $4.2 million balance? Here is the chart of the option price over the past few days.

Instead of bragging about their account size, they should be taking some advice from Gord and the boys, "He said, I'm fabulously rich. C'mon let's go" and hit some bids...

So in summing up the negative gamma situation, yeah, it's making the situation worse, but something else is driving the stock to the moon.

And before I tell you my theory, I want to tell you a story...

I think it was in 1999, but I can't remember the exact month. I was sitting on the institutional desk at a big Canadian bank. I was the institutional equity derivative trader but worked closely with the main desk. My good friend and original boss (and the fellow who gave me my start on the desk) was the main liability trader. He traded most of the crazy inter-listed names which included Nortel. At the time, Nortel was the darling of the Canadian market. It accounted for a god-forsaken amount of our index. It was big (by Canadian standards) and liquid. I still remember the day clearly.

"Andrew, pick up Fido."

My buddy hops on the direct line and after some whispering, time stamps a blue ticket, terminates the call, stands up and yells "Nortel. I'm a big buyer. Got 2 million to buy at my discretion. Make your calls, but I'm going to start taking stock on the board because they sounded like they don't want to miss any."

So Andrew starts buying everything that isn't nailed down. No institutional clients want to sell him any size and he starts marching up the stock trying to find some liquidity.

An hour later he's bought 300,000 and he's working the order in the market making sure he doesn't miss any size.

The Fido line blinks again. Andrew hops on and I can quickly tell the conversation isn't going well. Maybe they are mad at how much Andrew is moving the stock up. Maybe they aren't pleased with how aggressive he is being. All I hear is Andrew apologizing and ensuring him that he will fix it. Click. He hangs up.

"Listen up crew. I need to BUY STOCK! The big dog is rabid mad that I haven't bought enough. They have another 3 million behind (and that's all they are telling me about)."

And so, Andrew proceeded to march Nortel stock higher like a boy scout raising the flag at a jamboree.

The moral of the story? When the big accounts come for a stock, it doesn't matter how stupid the price, they just need to get it in. They are the scariest ones out there because they can keep buying for days, weeks, months and sometimes even years.

Which brings me to today's Tesla price action. Yes, retail option buying is helping push it higher. And of course, the big short base previously helped the rise accelerate.

But this move is being driven by big real money.

Why are they reaching for the stock? It has become the go-to name for the ESG (environment social governance) crowd. I don't want to discuss the merits of their logic, but let's face it, how can you not own Tesla with a big ESG mandate? It's become the poster child for this rapidly growing segment of the market.

Don't believe me? I think you can actually see the money flowing out of fossil fuel energy names and into Tesla. Look at this intraday chart of Tesla versus the inverse of the XOP ETF.

Every tick lower in XOP (higher on the yellow line) saw buying in Tesla (except for the last 20 minutes - which I will get to in a minute).

Big money is pitching fossil fuel companies and buying new generation energy companies like Tesla. That's the real reason for this maniacal rise. Like I said in a previous article, it's 1999 all over again.

Now let's get to that end of the day sell off. Eventually the rise in Tesla has to stop. And with all the negative gamma out there, it's going to be ugly on the downside.

The other day a good friend told me that recently my articles lacked actionable ideas of the 'tourist of old. Yeah, guilty as charged. Maybe it was the remnants of my brush with corporatism last year, but I have not been good at spelling out in my usual unashamed dad-bod-in-a-speedo embarrassing way what I have been doing. So here it goes.

After yesterday's quick plunge in Tesla, I shorted a starter position. For the first time I felt I had a stop I could define my risk with. I can use the old highs to lean against. If it heads back to $960, I will know I am wrong and give up. However, risks are now much more pronounced to the downside. The fever has finally broken.

Thanks for reading,

Kevin Muir

the MacroTourist

PS: Some people have also asked what I meant the other day when I said "buy the periodic table". Tomorrow I will go through why I am buying copper, energy and other commodities (in that order of preference) down here.