WHY HAVE WE BEEN SCREAMING HIGHER?

It's the easiest fiscal policy in more than a decade...

The stock market has been on a tear recently. There are lots of reasons being tossed around, but let me give you my interpretation of what's happening.

This will be a simple explanation. No doubt there are more factors at work than my rudimentary theory, yet this is my working assumption as to the source of the violent rally.

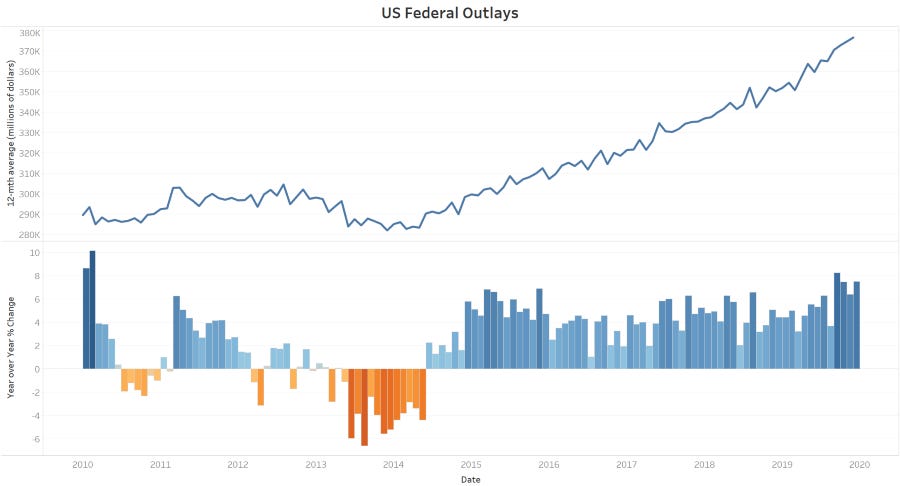

The US is the G10 country with the most aggressive fiscal policy stance. To get a sense of the extent of that accommodation, have a look at the US Federal Government outlays since the GFC.

Notice how during the Obama administration, the Federal Government outlays fell.

Since then they have been steadily creeping higher. So much so that they recently hit the most accommodating levels in the past decade.

In our balance-sheet-constrained environment, a Federal government willing to push the fiscal gas pedal down to the floor is a rare and welcome sight. This is causing the US to be the best performing economy out there.

However, in 2018 Jay Powell was worried about a financial asset bubble. When he took the helm of the FOMC, he was determined to nip any developing bubble in the bud before it took root. Powell pushed short rates higher, in the process elevating real rates to levels that hurt the global economy.

Finally, in an emotional stock market meltdown that culminated with the infamous Christmas eve massacre, Powell turned tail and gave what Wall Street and Trump wanted - lower rates.

It gets a little more complicated because even though Powell retreated in terms of the level of rates, he continued shrinking the balance sheet through quantitative tightening.

However, eventually the money markets also squeezed Jay & Co. to their pain point with the September-repo-mini-crisis, and the FOMC board once again rolled over and provided the accommodation the market demanded.

On top of this submission to the money markets, the Federal Reserve has also recently indicated they are willing to let the economy run hot - reiterating that the 2% inflation level is a target, not a ceiling.

I am not judging these decisions, they are what they are. Yet we now have a Federal Reserve that has taken any premature curve tightenings off the table, but also given the green light to letting the economy run hot. When you combine those monetary developments with the most accommodative fiscal stance in a decade, it is little wonder the stock market is screaming higher.

Now don't misconstrue this to mean I am bullish on stocks and recommend you chase them up here. The froth is so thick, I am scared we could get a 10% swoosh lower in the index at the slightest tick of bad news. But I wanted to explain that the shift in policy at the Federal Reserve policy, along with the fiscal taps being wide open is a combustible environment for risk assets.

Thanks for reading,

Kevin Muir

the MacroTourist