WEEKEND COLOUR COMMENTARY

For the week ending December 22, 2019

This Week's Must-Follow Twitter Account

My favourite way to test if someone is a millennial is to ask if they post pictures of their food to their social media account. It's not foolproof by any means, but twitter pictures of what that person ate that night does a pretty good job at separating the Gen-X's from their younger peers. Pictures of dinner? I don't get it, but what do I know? I still think the 1980's new-wave band period was one of the best eras for music. Hands down. Period. And don't give me that the 1960's-were-better crap. You millennials know what my response to that will be...

This week's must-follow Twitter account is definitely a millennial, but once you get over his nightly food tweet, you'll be thanking me for the recommendation. Luke Kawa (follow him here) is a fellow Canadian who like many of our smartest, funniest and best dressed, Canada has lost to America (I will let you figure out which of those is Luke).

Luke works for Bloomberg in NYC and you can often see him on TV throughout the day. But the real hidden gem of today's highlight is Luke's newly-created newsletter - the WEEKLY FIX.

It's free and you can sign up here (sign up dialog box is in the upper right-hand side of splash page). It's fixed-income oriented, but I think market participants of all asset classes will find it worth their while.

Luke is one of the good guys (anyone with a picture of a cow as his twitter banner is A+ in my books). Give him a follow and a subscribe - you'll be thankful.

This Week's Podcast Recommendation

Most people recognize Reformed Broker, Josh Brown. It seems like he is on CNBC all day long and I was surprised he actually has another job (just kidding... kind of). But you might not be aware that along with Michael Batnick and Barry Ritholz, they have a podcast called, The Compound Show (Apple iTunes link).

It's actually more than a podcast, but also a video series on YouTube. I know that seems unconventional, but it's actually a great format. If you want to watch it on YouTube, here is the homepage.

As for episode recommendations, give Ted Seides "Hedge Funds Have Their Worst Decade Ever - Now What?" For those who want the Podcast version, it's here. As you know, I am a big Seides fan and it's a joy to see someone switching seats and putting him in the interviewee spot.

The MacroTourist Post

My bearish Canada piece had a bunch of interesting feedback. On twitter, Zay wondered if my worst case might be a little baked in and that energy surprises might give the Loonie a bid going forward:

My pal David agreed that Druck's global-reflation-buy-Canada view was currently winning the war:

However, my favourite feedback was the following:

QUOTE FROM MACROTOURIST PIECE:

“However, I worry about using the old playbook in this new environment. The other day when I wrote my bearish CAD piece [SELL THE LOONIE AGAINST EVERYTHING], the main pushback was; "why would you want to be short a commodity currency into a growing global economy?" I understand this view. And that's the same logic Druck used. But this is a case of investors looking too broadly and not examining the country-specific issues. “RESPONSE FROM READER:

Kevin: As you know, this happens all the time!! Rule-of-thumb application of a metric from a bygone era… it happened with the US yield curve this year, which was less a recession signal and more a matter of global demand for yield and the trading activity of prop traders looking for “duration juice” in the intermediate part of the curve for their “Fed is taking rates lower” trade… and as you know , the prop trading bros are largely agnostic on fundamentals…

From another reader who is well-placed in the Canadian pension world:

Thanks Kev. Continue to enjoy your posts all most as much as the endless inventory of great pictures! I’m also concerned about Canada... no near term resolution to land locked oil and gas, housing bubbles in Vancouver and Toronto and generally high consumer credit, uncompetitive tax policy relative to the US and a government that is run by a drama teacher who has outsourced most of his responsibilities to a Freeland and a Finance Minister that loves to show massive budget deficit over-runs most of which is shamelessly linked to vote buying vs. Investment in the economy.

Last comment to share with you is one I couldn't agree with more.

Druck doesn't bother worrying about what everyone else is worried about because he knows that's probably in the price.

Chart of the Week

You know what I like best about the tin-foil-hat crew? They can laugh at themselves (at least some of them can). And no one does this better than Dave Collum.

Dave is a professor of chemistry but publishes a yearly in-depth investment review that is a must-read for this crowd. This weekend he released his 2019 edition. Even if you don't prescribe to this line of thinking, it's a great read. We should all take the time to understand each other's point of view. Dave's year-end piece is good pushback to those of us who believe things are not as bad as the ZH crowd contend.

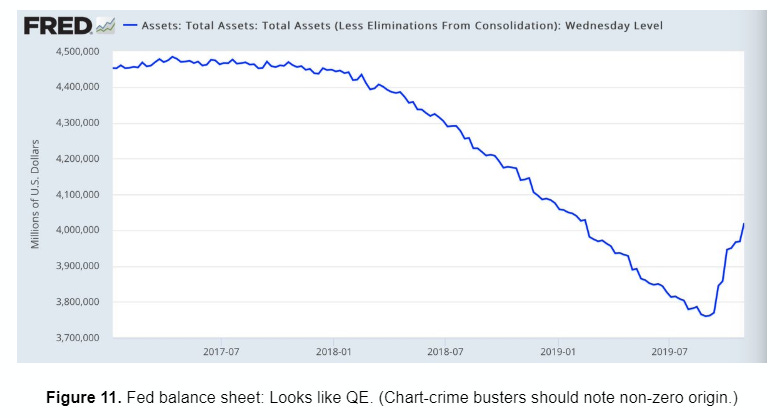

I want to leave you with a chart that Dave calls out as a chart-crime, but not before posting this hilarious picture:

The chart-crime in question:

The only thing I know about with Dave's piece? I am sure each one of you will find some part offensive - and he wouldn't want it any other way.

Thanks for reading,

Kevin Muir

the MacroTourist