WEEKEND COLOUR COMMENTARY

for the week ending January 31st, 2020

I am a big Michael Lewis fan. However, when he wrote "The Undoing Project", I was not drawn to it. In fact, I wasn't even planning on reading it until my father gave it to me.

Thank goodness I did! It was one of Michael's best books.

THIS WEEK'S RECOMMENDED PODCAST

The reason I bring up "The Undoing Project"? My podcast recommendation this week interviews the main character from the book.

Farnam Street is one of my favourite websites and newsletters. If you don't yet subscribe to Shane's weekly letter, make sure you sign up.

And while you are at it, add his podcast to your list. You can start with Episode #68 with Daniel Kahneman.

TWITTER FOLLOW

I like when people bring to my attention smaller twitter accounts that are just quietly adding value for the financial community.

Fire Fly @flowfocus is exactly one of those accounts.

Not sure who is behind this content, but give @flowfocus a follow. Good stuff!

MACROTOURIST POSTS

THE OTHER VANNA

Although technical in nature, this post was an important one for regular market observers to understand.

One of my regular readers who I always enjoy communicating with had some insightful comment that I felt I should share. Igor Ojereliev at RGL Capital wrote the following:

Hi Kev,

Yes very good post, if you think about it intuitively you do not even need to recall Vanna. If you hold and asset because you expect a return of 5% +/-1% you will be willing to pay X for it, however if you still expect 5% +/- 5%, I argue you should be willing to pay less than X. So as distribution of returns rises (even though expected return stays the same) you should adjust the price downwards. The opposite is also true, as you progressively believe that the “Cycle is Dead” J you should be willing to pay more for assets. Actually I believe that was the main cause for Dec/Jan rally, as people concluded that FED is there to prevent even minimal sell off they bid up asset prices. Weather the current correction changes that assumption – remains to be seen, however sell off is still very muted, we barely retraced Jan rally (not even everywhere), sell off only feels “strong” since we have not seen 1% move in a long time. By extension once we see 3% move down on SPX, that may be a sign of bottoming out as VANNA will clear short term traders out.

Best, Igor

PS By the way VANNA stands for bathtub in Russian, I am sure there is some irony in that and may be this the “other VANNA” option traders are talking about...

THE WORLD'S BIGGEST STEEPENER

I just realized that both of my posts this week were a little "quant-ie" in nature. The first article was about equity index option pricing dynamics and then just to keep it light, I followed it up with a post about European bond peculiarities.

I had the pleasure to meet a fellow Canadian who wrote a terrific response to my article. Laura Chelaru, who works at fixed income sales at Laurentian Bank, sent me an insightful email regarding the bid at the long end of the curve in the rest of the world.

Really enjoyed today’s write up. The bid for duration for the reasons you describe below is obvious in all developed markets that have a liquid long duration swap curve (alas, Canada is not one of them). It answers why the US swap spreads term structure is negative.

In Canadaland, you see it in 10s30s curve flattening to nothing relative to where short rates are (not in front of my terminal right now, but plot cayc1030 inverted vs gcan2yr - the two used to trade on top of each other, which makes sense - if short rates are low, long end curve should imply growth+inflation. Since the summer this relationship has come undone, partly as the rest of the world has piled into the us and Canada bond mkts, unhedged. Duration is duration is duration.

Your peer Leo Kolivakis has written about the same problem you are highlighting below w insurance as it applies to US public pension funds, which despite over a decade long stock market continue to be greatly underfunded. I agree with him that this is a huge crisis in the making.

On convexity specifically, read a good JPM piece in the summer that explains simply that there are many fixed income convexity buyers (mortgage books, pension funds, insurers) and very few fixed income convexity sellers (banks via convertibles) to make for a balanced market. Could dig out the name of the author if you care.

The reflation/fiscal stimulus trade is wishful thinking, truly. A real curve would make my job as a fixed income salesperson much easier (you can imagine the enthusiasm with which my clients respond to curve retractions to pick up 2bps). It’s also something everyone is positioned for via steepners (5s30s is so hot right now) - this trade makes money if things go really well (growth and inflation!) or if things go really badly (policy rate cuts) so it’s easy to justify. It is also super crowded. And it ignores the bid for duration described. Since the summer, all cda 30yr bond sell offs past 1.70% and all us sell offs past 2.40 get bid immediately. I want to believe we steepen but I can’t! And if we do, I have time to get in that trade given poor positioning.

Bunds are a different story due to real rates being so negative there. I don’t understand how Germany doesn’t take advantage of this situation to spend. There’s a us treasury/bund trade in there...

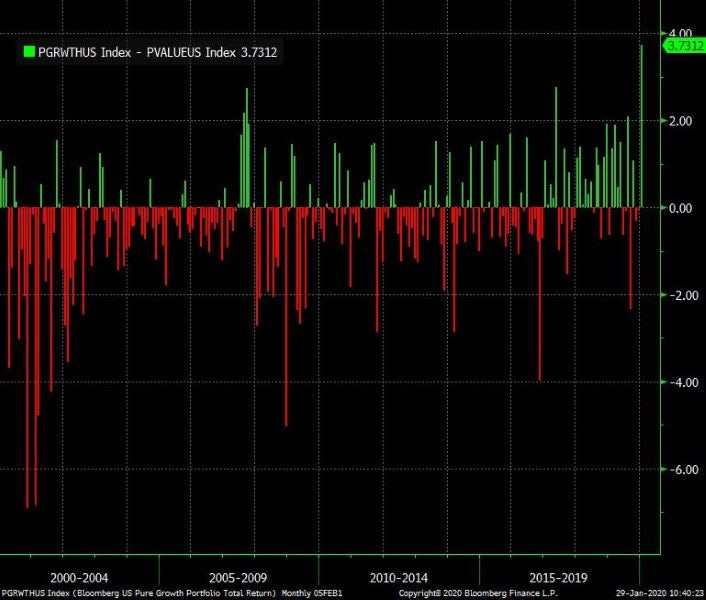

CHART OF THE WEEK

Thanks for reading,

Have a great rest of the weekend,

the MacroTourist

Kevin Muir