WEEKEND COLOUR COMMENTARY

This week's Must-Follow-Twitter Account

Whenever a novice trader asks me where to start learning, the first thing I tell them is to get a twitter account. Never before have so many knowledgeable people shared their experiences with the investing public. The information that was previously confined to trading desks is now freely available to anyone with an internet connection. It's mind blowing how great the content is out there.

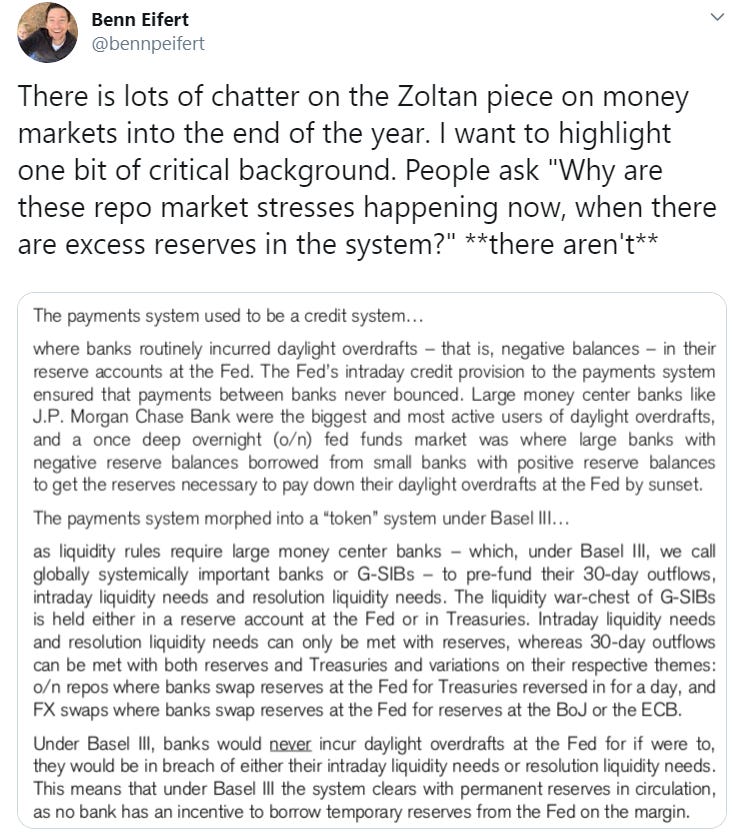

One of those individuals whose thinking would have previously been land-locked within his immediate network but is now circulating throughout the financial community (thanks to twitter) is Benn Eifert.

His recent analysis regarding Zoltan's controversial piece about potential year-end repo liquidity issues is indicative of Benn's great content.

Give Benn a follow, you won't regret it.

Podcast Recommendation

This week's podcast discovery needs a NSW disclaimer, but gosh darn, this guy can tell a story. If you want to hear about some of the more depraved and hilarious inner-workings of the hedge fund world, give Occupy a Job on Wall Street a listen.

I don't want to recommend a single episode because the ones I really like might result in you thinking less of me. Subscribe to the podcast, you won't regret it.

MacroTourist Post

Inflation - We Gonna Let'er Run Hot

I took a cheap shot at Paul Krugman, and little did I realize, there are actual Krugman fans out there that read my letter:

Kevin,

Thanks for the note.

I have to say I’m puzzled at the degree of Krugman hate out there.

He has got this cycle right. He correctly criticised the inflationistas when the Fed did QE. He correctly highlighted the potency of fiscal policy, particularly the adverse impact of fiscal tightening. And he correctly excoriated the Republicans for their fiscal fantasies, both ‘expansionary austerity’ and Laffer curve/trickle down nonsense.

In short, can you tell me another high profile media economists out there who got it more right than him? I don’t know of any.

As to the broken window fallacy, have you got a link to show that Krugman disputes it? I’ve read Krugman for years I can’t remember any example.

Thanks again for your commentary. I sometimes disagree, but that’s what makes a market.

I like readers keeping me honest, and asking me to defend my position that Krugman doesn't fully accept the broken window fallacy is a great example of that. I appreciate this reader's analysis of Krugman's actual calls. Maybe I am being too hard on him, so I will try to keep an open mind to more of his comments.

As for my main criticism, I found this CNN Interview - "Paul Krugman: An Alien Invasion Could Fix the Economy".

I guess I stand by my view of Krugman, but as my loyal reader wisely pointed out - that's what makes a market!

MacroTourist Post

Not Positioned for this Possibility

This was my favourite piece this week. What I found interesting about the feedback was that many readers expressed interest in buying other equity markets, but almost no one was willing to agree with my call that U.S. would underperform.

This was a typical response:

I don’t disagree it has been a very strong trend and it is crowded.

However, I am left unsure what the catalyst is in your view. We both know positioning for major trend changes when the trend is still intact is often a fool’s errand that can see you carted out just prior to your prediction proving “correct”

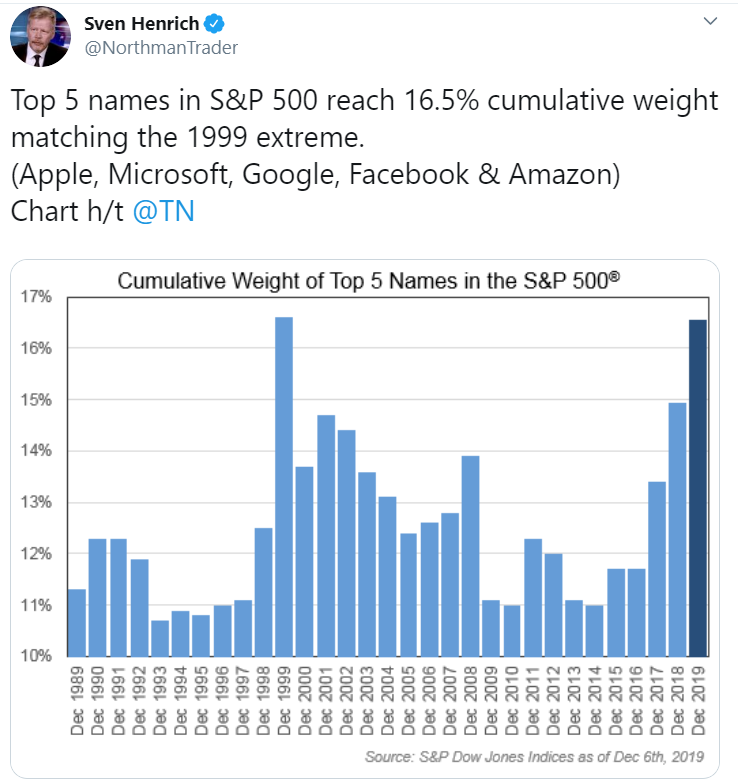

On another note. A couple of shrewd market watchers emailed me (independently) a version of this chart:

This is the ratio of the EEM to SPY ETF. You will notice it turned up this past week from a depressed level.

And here is a longer term version of this same ratio:

No doubt it is cheap! I love EEM and although my grandmother keeps trolling me on twitter about my bad call (she has recently gone 100% long SPY), I stick by my view EEM will outperform in 2020.

On a final note, one reader sent me the following message:

I love this. Also can I get your grandma's Twitter handle. :)

I am sorry to tell this reader that my grandmother is already involved in a throuple-type relationship with two men in her old-age home, and not interested in adding any more to the mix. Plus, I checked this reader's bio and my grandmother is way too old for him...

MacroTourist Post

Endogenous Money for the Rest of Us

Apart from getting the basic definition wrong, I thought this was a good post.

Steve Keen is a professor of economics who deserves your attention. When he calls me out on my post, I feel a little like a 20-year old who didn't take the time to proofread my paper. Inside, outside... who can keep try of which economic forces are what?

Kidding aside, this piece tackled a complicated topic. I tried to make it simpler, but the fact is that sophisticated economic professors debate this issue all the time. Although I firmly believe in endogenous money theory, it is by no means accepted in main-stream economics.

I want to clarify that this post was not some sort of deflationist conversion for me. I have long believed that inflation will not be created by monetary policy, but instead through fiscal means. Endogenous money theory is actually the reason I believe that extreme monetary stimulus (like what is happening in Europe) will not work, and therefore why fiscal stimulus will be the only solution to reviving private balance sheet constrained economies.

While we are talking about these modern money type theories, I would like to take a moment to highlight a podcast I had the pleasure to appear on.

The MMT Podcast with Patricia Pinot and Christian Reilly is a great resource for those who would like to learn more about the MMT movement. They were kind enough to have me on and you can find the link here.

I believe in separating the descriptive part of MMT from the prescriptive part. Most of the complaints about MMT come from the prescriptive part - what MMT-advocates would like to implement based on their understanding of the way modern money works. Yet the descriptive part is actually the portion that interests me the most.

If you examine many of the best strategists' and most especially - fixed-income short term plumbing practitioners' views on the economy, they are often MMT-consistent. I believe there is a lot of value added in understanding MMT theories.

However, too often I get slotted into a difficult place from my open-mindedness. As I joked with Patricia and Christian, the Wall Street crowd hates anything to do with MMT so the moment I say some of their theories might have value, I get dismissed as a crazed lefty. Which is funny because if you know my stance on Canada's energy policy, the lefties think I am a free-market-monster. The MMT'ers don't like my belief that sovereign debt markets have value, and no - you shouldn't peg all interest rates to zero - and that there are portions of the private side of the economy that MMT theory glosses over. So on the whole, they don't like me either. Neither side likes me, so I conclude I might be onto to something.

I like to think I am an economic realist, but maybe I am deluding myself and I am simply talking my book like most everyone else. But I try to be open minded, so when a good buddy, Jim Osler sent me his feedback on my appearance on the MMT podcast, I tried to really listen to what he had to say.

Now, Jim is a libertarian. A rather staunch one at that. Years of working in investment banking and seeing the government mess things up has made him believe the government can do nothing right. I disagree. But I like debating Jim. Again, he keeps me honest, but since this is my letter, I can control the tone, and I am going to first include my favourite libertarian meme before Jim's rant:

With that out of the way, here is Jim's pushback on my MMT argument:

Now for a little breakaway rant. You triggered me. This morning I listened to about 30 minutes of the MMT podcast that you were on. You were great and it was entertaining to hear how the hosts reacted to your litany of swear words (not the 4-letter types, but the ones like "markets", "entrepreneurs", "trading"). They had to do a 2 minute public advisory warning to start the episode because of the offensive ideas you were putting out there like Trump may be doing something (accidentally or not) that isn’t wholly evil or could be considered consistent with their beautiful and divine theory.

I get your idea that there is a difference between the theory and the practice of MMT, but your hosts didn’t sound really interested in that. They were loving to hear you say "conventional economics is a failure" and "MMT properly describes the world" and were quick to add the prescriptive elements "and that is why the Green New Deal is the only sensible solution". I think that is why you get a lot of heat on this. It is difficult to split the descriptive brain exercise and the prescriptions on how to change the world. It is my fundamental problem with Marxist thinking. They won’t debate their ideas using reason, instead they either attack the speaker rather than the argument, or they divert the discussion with complex-sounding theory or nonsense words to get away from addressing any rationale criticism.

I also need to you to explain over beers why the descriptive parts of the theory clashes with my understanding of economics because I don’t really see it. Friedman doesn’t say that printing money > inflation, he says inflation is everywhere and always a monetary phenomenon which I understand to mean that it shows up after you have done something to the quantity of money, not the other way around.

My concern (and I think you are at least on the same “inflation is coming” bandwagon as me) is that we have had a number of deflationary pressures since the 1960s due to increased global trade primarily that has been largely offsetting government spending. Those trade benefits are being unwound now and the easy gains of brining China and India out of the stone age to modernish productivity are largely done / facing structural headwinds. The Fraser Institute (yes another right wing thinktank - ) estimates that Canadians paid 39% of their average cash income in taxes in 1969, the year our PM’s father became PM. Today that number has increased to over 44%. The savings rate hasn’t materially changed at those two points (around 5-6%) and there have been no new national programs launched since 1969 so this is really just inflation in the cost of delivering government services (and they still run big deficits!). The cost of everything else in the consumer basket has effectively gone down in real $ over this period of time. I don’t think the private sector inflation dampner has a lot more room to run, especially if you consider the regulatory, tax and licensing headwinds that have accumulated on it since the 1960s. Now a carbon tax that will be revenue neutral? It’s a death spiral where government keeps sawing off the limbs of the tree to burn until the tree is dead.

I came across this fascinating history of the end of the Roman empire and how inflation ultimately wrecked it. Their solution sounds very MMTish (increase the size of government to assess the productivity of the empire and erect a large bureaucracy to collect taxes through conscription and the elimination of markets) and it ultimately led to the creation of feudalism and a massive slave / serf state (but everyone had jobs for life!). I think I may have already shared it with you before but here are some excerpts from a piece originally written in 1984 that is foreshadowing the world we are descending into today.

https://mises.org/library/inflation-and-fall-roman-empire

"The result was that the government, in order to try to protect its civil servants and its soldiers from the effects of inflation, began to demand payment of taxes in kind and in services rather than in coin. They wound up, in effect, repudiating their own issued coins, not accepting them for tax collection purposes."

“Now one interesting thing with all this inflation should be a great comfort to us: historians of prices in the Roman Empire have come to the conclusion that despite all of this inflation — or perhaps we should say, because of all of this inflation — the price of gold, in terms of its purchasing power, remained stable from the first through the fourth century. In other words, gold remained, in terms of its purchasing power, a stable value whereas all this other coinage just became increasingly worthless.”

“One of the Christian fathers, Saint Gregory Nazianzus, commented that war is the mother of taxes. I think that's a wonderful thing to keep in mind: war is the mother of taxes. And it's also, of course, the mother of inflation.

Now, what were the consequences of inflation? One of the odd things about inflation is, in the Roman Empire, that while the state survived — the Roman state was not destroyed by inflation — what was destroyed by inflation was the freedom of the Roman people. Particularly, the first victim was their economic freedom.”

“This [forcing tradesmen to produce goods for the state] was not sufficient because, after all, death is a relief from taxes. So the occupations were now made hereditary. When you died, your son had to take up your profession. If your father was a shoemaker, you had to be a shoemaker. These laws started by being restricted to the defense-oriented industries but, of course, gradually it was realized that everything is defense-oriented.”

“Salvian tells us, and I don't think he's exaggerating, that one of the reasons why the Roman state collapsed in the 5th century was that the Roman people, the mass of the population, had but one wish after being captured by the barbarians: to never again fall under the rule of the Roman bureaucracy.”

For all you hard-money-the-government-is-evil types, give Jim a follow. Actually, you should all give him a follow because it's important to keep an open mind.

Closing Chart of the Week

Thanks for reading,

Have a great weekend,

Kevin Muir

the MacroTourist