THE WORLD'S BIGGEST STEEPENER

European life insurers face a huge balance sheet mismatch

It's been a while since I have written about German bunds and other nuttiness in the European fixed-income markets. Although I am still long-term kodiak-grizzly-bearish on European bonds, I have had the good fortune to make friends with Mattia Parolari from Barclays Bank in Paris. Mattia is an institutional rates strategist specializing in European fixed-income. We have had numerous Bloomberg chats where he has patiently explained the problems in European fixed-income markets, but more importantly, highlighted the structural mismatch of liabilities versus assets in European financial firms' balance sheets. Unfortunately, I come to no Cramer-like conclusion (neither BUY-BUY-BUY nor SELL-SELL-SELL) from the following analysis, yet it's fascinating stuff that sheds light on the gong-show that is European fixed-income.

Let's review where we stand by having a gander at the chart of the German 10-year bund yield over the past year:

Last January, the yield was hovering at a still-obscene +25 basis points, but at least it was positive. Then, due to a whole host of reasons (but in my opinion, mostly due to the Fed's mistaken tightening of financial conditions), yields collapsed in Germany. The decline in yields started slowly, pushing below 0 basis points in March, but then July rolled around. In a sickening swoosh, the 10-year German bund yield fell from negative 20 basis points to negative 75 basis points.

A lot of market participants still do not fully appreciate the downward crash in European bond yields that occurred last summer. It was epic.

The real question to ask is why? Did the prospects for the German economy deteriorate enough to justify a decline in 55 basis points in less than two months? Was minus 75 basis points the correct price for 10-year German debt?

Well, unless you believed German inflation will not be inflation, but instead deflation of more than 75 basis points for the next decade, bunds were a terrible investment. It's tough for me to even begin to describe the absurdity of this anomaly. It's like Dumb & Dumber were put in charge of bond pricing. Don't even get me started on the CNBC-portfolio-managers who this summer somehow advocated buying bunds on the belief that they could go even more negative! Yeah sure, it could happen. But at that point you are no longer a portfolio manager. You are just a degenerate river-boat-gambler. There is zero fundamental argument for locking in negative nominal rates (and even greater negative real rates) for ten years.

Yet you could have said this at zero basis points, and then the same at minus 10, minus 20, etc... Someone must have been buying the bunds at all these absurd levels. It can't all be BlackJack Snoopy's driving bunds to the moon.

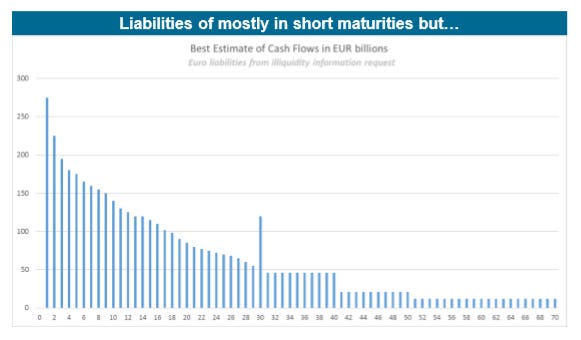

This is where my discussions with Mattia shed light on the situation. Let's grab one of his charts from the EIPOA report. This governing body's acronym stands for the European Insurance and Occupational Pensions Authority. They survey members to understand their liabilities.

At first blush, their liabilities look fine. Most of them are centered near the front of the curve. However, this is where Mattia's hard work kicks in. When you calculate the duration adjusted liabilities, a huge glaring hole becomes apparent.

These financial institutions are stuffed to the gills with 50-year+ duration risk!

Want to get a size of this liability mismatch? Mattia tells me;

"economically, insurers are short 2 billion per basis point of 50y+ duration. That is approximately nine times the TOTAL SIZE of the EUR government bond market."

The European insurers are long the belly of the curve and short the ultra-long end. They have the world's biggest steepener trade on.

You can get a sense of their pain from the shape of the European swap curve. Look at how it is upward sloping until you get to the long end. Then it kinks downward because these financial companies are short SIZE at that tenor.

When this summer's bond market melt-up gathered steam, the spread between 30-50yr EUR swap levels got even more negative.

Now, I want to take a moment to explain that I am not a fixed-income expert by any means (I don't even play one on TV, but I did stay at a Holiday Inn Express last night). I cut my eye-teeth trading institutional equity derivatives and most of my bond knowledge is self-taught. I have been extremely fortunate to have people like Mattia help me, but remember - we are now venturing into an area that even some bond traders (especially those at European insurers) have not fully appreciated, so please forgive me if I don't articulate this conundrum properly.

Have you ever been overwhelmed by a bond-wonk nattering about the wonderful convexity of an extremely long-dated bond issue? This summer my twitter feed was filled with them. I must admit, I probably didn't fully appreciate the risk-reward opportunity they were touting.

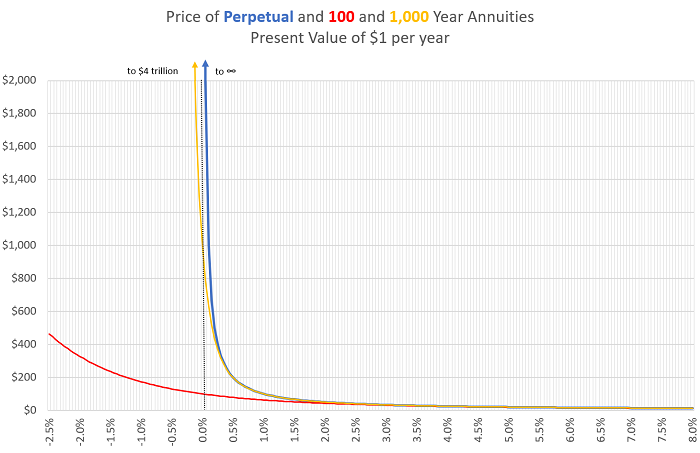

During the bond melt-up, Victor Haghani from LTCM fame, wrote a piece titled "Negative Interest Rates and the Perpetuity Paradox". The whole point of his piece was to highlight the convexity of longer term fixed-income assets. To demonstrate this, he created the following chart:

"The main thing to take away from that chart is that those are not straight lines. They are very curved way up. That's the main conclusion to draw from them. And that has implications about how we think about going long or going short those bonds." - Victor Haghani

Think hard about that last line... "that [curvature] has implications about how we think about going long or going short..."

The key takeaway is that the longer the bond, the more convexity (curvature) it has, therefore the greater it accelerates to the upside as rates approach zero.

Let's remind of ourselves who is short that sort of long-term liability - the European life insurers. And what are they long? Bonds with a shorter duration. So what's happening with these crazy moves in European bond markets? The insurers' liabilities are more convex, so they are rising way faster than their assets.

I don't want to steal all of Mattia's thunder, but if you are an institutional client, then I suggest you reach out to learn more about the best way to take advantage of this setup. Mattia definitely has trades designed to profit from this understanding, but they are geared solely for institutional accounts. He is best reachable on the Bloomberg.

For the rest of us who aren't trading Euro swaption vol, or ultra-long 100-year issuance versus 10-year bunds, what are the opportunities?

When I was working through the problem with Mattia, I had my breakthrough moment when I realized that if the European insurers were short 50+year liabilities while long shorter-duration assets, this summer's crazy move was most likely driven by this mismatch. The convexity of their liabilities had accelerated versus their assets forcing insurers to chase European bonds of any sort higher in a desperate attempt to catch up with their growing liability. In my mind, I came to the conclusion they were short a unique sort of gamma. That's why this summer's move was so frantic. They just needed to get it in and there was no one there to sell it them.

And are their macroeconomic implications?

When I first learned about this large liability mismatch, my instinct was to guess that if the life insurers marked to market, they would be insolvent. The bearishly-inclined would probably conclude hitting European life insurance equity bids was the logical way to express this view. I look at it differently. If I am the CEO of a big German life insurance company, will locking in record low rates at levels that result in a massive hit to my company's valuation make the most sense?

Sure, there are accounting games to be played that put off the day of reckoning. France for example is pushing through reforms that help with problem [Life Insurance: the sleight of hand of nearly 40 billion].

Call me naive, but this is a band-aid solution that can't last. Eventually, European life insurance CEOs will demand interest rates go back up. You might say, "but they have been trying to get rates higher for a decade, and they have failed miserably." Well, I would argue they haven't understood the role that fiscal plays in allowing a Central Bank to set rates higher. I am confident that instead of life insurance companies lifting every offer bund offer on the screen at these negative rates, the CEOs will convince the powers-that-be that fiscal spending is needed to both send rates higher and also give the life insurers the duration they desperately need to buy.

We are already seeing increased issuance of 50-100 year bonds as issuers realize the monster bid out there. Mattia sent me the following update a couple of days ago:

1) Two 100y Ireland private placements in Q4

2) NRW issuing a 100y BENCHAMRK (1.3bn EUR - Barclays Lead Manager... just saying ;)))

3) Uni of Oxford tappign their 100y

4) 100y Austria tap (Barclays sole arranger) yesterday

My guess is that the Germans will finally relent on their insistence on balance budgets and solve two problems at the same time by doing massive deficit spending and fund it by issuing ultra-long-dated bonds.

I know that seems insane and completely un-German. However, when I see "Mr. Black Zero" himself shifting stance, I sit up and take notice. From a Reuters article "Germany's Schaeuble heats up debt debate with call to rethink fiscal policy rethink":

BERLIN, Sept 25 (Reuters) - Former German finance minister Wolfgang Schaeuble, the mastermind behind Berlin’s “black zero” budget policy of not taking on new debt, has called for a reappraisal of its fiscal policy to meet the challenges arising from climate change and digitalisation.

Schaeuble’s words carry weight among Chancellor Angela Merkel’s conservatives and could influence a debate about whether Berlin should use new debt to boost public investments to help the economy, which is on the brink of recession.

Speaking at a business event in Berlin, Schaeuble said that 70 years after the founding of Germany’s Federal Republic, politics and business faced the task of re-adjusting the economy in the face of globalization and digitization.

Schaeuble, now president of the Bundestag, the lower house of parliament, said the government had to do better to reconcile three different aspects of sustainability - economic, social and ecological.

“This includes taking the risk to think new things beyond the status quo,” Schaeuble said, according to the text of his remarks.

“The willingness to question one’s own mentality to some extent, possibly even our traditional model, first of all to save, then to invest what has been saved - because it turns out to be not dynamic enough given the challenges we need to respond to.”

“It’s about being more flexible, more courageous - but not overdoing it,” Schaeuble said, adding that the government should continue to practice moderation in permanently combining ecological and economic sustainability.

Merkel’s government has managed to raise public spending without incurring new debt since 2014 thanks to an unusually long growth cycle, record-high employment, buoyant tax revenues and the European Central Bank’s bond-buying plan.

But Germany’s borrowing costs are sinking to new lows almost daily and its economy cooling as foreign demand weakens. Calls to provide extra fiscal stimulus by running a small deficit again are growing louder.

The head of the powerful BDI industry association earlier on Wednesday raised the pressure on Berlin to rethink its budget priorities, saying Germany should ditch its policy of not taking on new debt in light of zero borrowing costs and huge investment needs.

Under the constitutionally enshrined debt brake, the federal government can take on new debt of up to 0.35% of economic output. That would be roughly 5 billion euros in 2020 after special factors such as growth have been taken into account.

The permitted debt would rise to 8.4 billion euros in 2021 and 9.7 billion euros in 2022, according to budget experts in parliament.

Schaeuble himself called on politicians to use the fiscal leeway of the constitutionally enshrined debt rules, implying that the no new debt policy should not be a mantra anymore.

“The global problems ... can only be solved if we invest more in other countries. This requires ideas for new approaches that allow such investments within the limited scope of our debt brake,” Schaeuble said. (Reporting by Michael Nienaber, editing by Larry King)

The issuance of ultra-long-dated bonds in the name of fighting climate change will give the deficit hawks the excuse they need to both help the economy while also ameliorating the life insurer problem. It's a win-win.

Yet how does one take advantage of this development?

First thing to note is that although European life insurers are in the process of trying to buy convexity to fix their balance sheet problem, they are still short "synthetic gamma". Therefore I think buying bund vol is an extremely attractive proposition. European fixed-income vol should only be bought. Never sold.

Next up - erring on the short side when it comes to bunds is the only way I will play it. I have been patiently watching this Chinese-flu-fixed-income rally from the sidelines, but it's time to take a stab at being short bunds again. And don't forget - express that view through put options.

If you are an institutional account, talk to Matt about more exotic ways to take advantage of this environment. He's got a full 50+ page presentation that you shouldn't miss. For the rest of us punters, buying bund puts is probably the best trade out there...

Thanks for reading,

Kevin Muir

the MacroTourist