THE HARDEST POST TO WRITE

Do you know how easy it would be for me to write a bearish piece? Olive Penderghast easy. Sentiment in the financial community is awful. The global economy was already stinking before Jerome & Co. tightened to the point of slowing the American economy. Now that the Federal Reserve tightness is finally biting and showing itself in the economic data, the last clean shirt in the dirty laundry pile is getting covered in stains. Combined with the ominous developments in the US / Chinese trade war and you have a recipe for doom.

If I were to write a post about the coming economic collapse and a re-run of a 2008-style crash due to the build up of debt, then trust me - it would be popular. The public’s mood is itching for this sort of view point. And I know all the arguments. You can’t fix a problem of too much debt with more debt. Buybacks are the only things keeping the stock market up here. There is never only one Fed easing so when they start, rates are going to zero. And so on and on and on.

Also, it’s not like I can’t imagine this outcome. I see all the negatives staring me in the face.

But let me tell you something I have learned the hard way. Whenever these “smart” gurus are all leaning one way, it seldom pays to join them in their trade. Remind me of the last time you saw the “fast money” consensus be right.

Yet do you know how hard it is to fade this crowd? You look like a mope. You’re the only person who “doesn’t get it.” All these hedge fund managers get on CNBC and express their views with such gravitas you question whether you should abandon your position and join them.

Want to know what all these smart folks are recommending right now? Well, instead of me telling you, let’s have a look at this great recap of the recent Mauldin Conference from Tarek I. Saab:

“Entire 4-day lineup was long bonds of various duration.” Let that sink in.

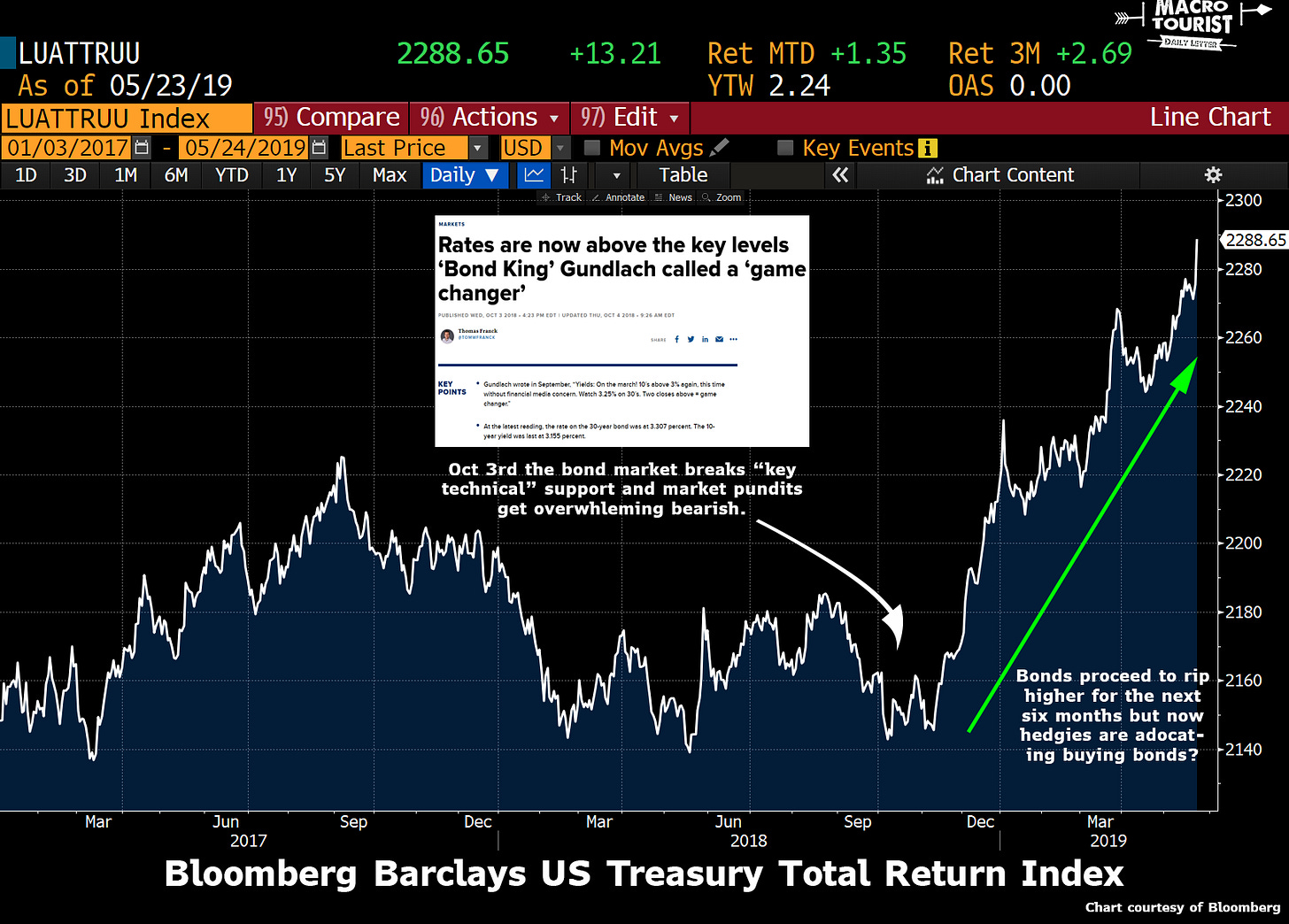

The funniest part of this love affair with fixed-income? It was less than half a year ago they were equally convinced bonds were heading lower.

Now you might say some bond bulls were touting their long position even into that ugly October so it’s not right to put all the “fast money” guys together. For sure. There were a handful of shrewd traders that faded the October bearishness. Roaul Pal and even that ‘tourist fellow come to mind (ECONOMIC BEARS THROW IN THE TOWEL).

The difference is that back then bond bullishness was viewed with skepticism. Today it is embraced with an enthusiastic hug.

Have a look at the JP Morgan bond client survey:

I know the survey isn’t perfect, but it confirms other sentiment indicators.

I’ll bet many of you want to send me a note telling me how when the economy turns, it keeps going and that the beginning of a bond move gets overbought and stays overbought. I kindly ask you refrain from doing so because it will only make me more bearish and I am already bearish enough. You might label me foolish for not seeing what is so obvious to all the presenters at the Maudlin Conference. Yup. Guilty as charged. I don’t buy that putting on a long position into this fixed-income euphoria makes sense with two Fed cuts already priced into the next year.

This spread instrument isn’t perfect, but the EDM9EDM0 is a crude approximation of the amount of Fed hiking or cutting expected in the next year.

Last October there was a full hike priced in, but now those expectations have completely collapsed to the point where there is two cuts already embedded into the Eurodollar futures curve.

Although it’s not quite this simple, to make money at the short end, the Fed will have to cut more than twice in the next year and a bit. Could that happen? For sure. No doubt about it. Maybe the economy hits a real air pocket and the Fed cuts aggressively. Or there is some geopolitical event and the Fed is forced to slash rates.

But the point to ask yourself is whether that is a good bet? I contend that with everyone leaning so heavily one way, the surprise will not be how much money they make, but instead if things don’t play out exactly as ominously as forecasted, how quickly the trade goes sour.

There is little room for error. Or put it another way, the global economy better collapse as quickly as these bears believe as even a lengthening of the process will make their trade unprofitable.

And in case you are bullish the long end of the curve and believe a slow-to-cut Fed is your best friend, don’t forget what Tariff Man has done to inflation. Next year should see a rise of 50 basis points across the board to core inflation. Sure commodities are falling hard, but that helps more with China’s inflation situation than with America’s.

Almost all of you will dismiss this post as idiocy. I get it. Sentiment is so lop-sided I know this will not be warmly received. But back in October when I preached caution with short positions even though “Bond Kings” were selling with both fists, it also was derided. I have learned like Olive, sometimes you have to not worry about your reputation and just do what you think best.

Remember, the hard trades are most often the right trades. And I ask you - what could be harder than fading the current bullish bond sentiment?

Thanks for reading and to all my American friends - have a great Memorial Day Holiday!

Kevin Muir

the MacroTourist