SYCOPHANTS AND OTHER PARTY STORIES

I have long argued that Trump didn’t realize what he was doing when he appointed Jay Powell to lead the Federal Reserve. Trump was not aware of Powell’s belief that the cost of a bursting of a financial asset bubble far outweighed its benefits and that the proper course of action was to never let one be inflated in the first place. Well, I should say that used to be Powell’s belief because Trump beat that out of him.

Powell no longer wants to get out ahead of a financial asset bubble and has abandoned any pretext of trying to stop the party by pulling away the punch bowl.

For his part, Trump has wised up to what he wants from a FOMC Board Member and will not make the same mistake twice (after all, it was a real pain in the ass complaining about Powell for those six months to bend his will - better to just get someone who will tow the party line right from the start).

And let’s just say, Trump has found his perfect candidate in Stephen Moore.

Trump’s propsed FOMC Board Member made headlines yesterday when he opined about monetary policy (from Reuters):

President Donald Trump’s expected nominee for the Federal Reserve Board of Governors, Stephen Moore, said the U.S. central bank should immediately cut interest rates by half a percentage point, according to an interview with the New York Times on Tuesday.

Yup. Trump has found his man. No more feigning concern for prudent monetary policy - let’s get this party rocking!

But it’s the next part that made me laugh. Stephen Moore had the audacity to claim the following (again from Reuters):

Moore, a conservative economic commentator and a fellow at the Heritage Foundation, told the Times he is not a “sycophant for Trump” or “a dove” on monetary policy, a reference to Fed officials who favor an easier policy that supports economic growth.

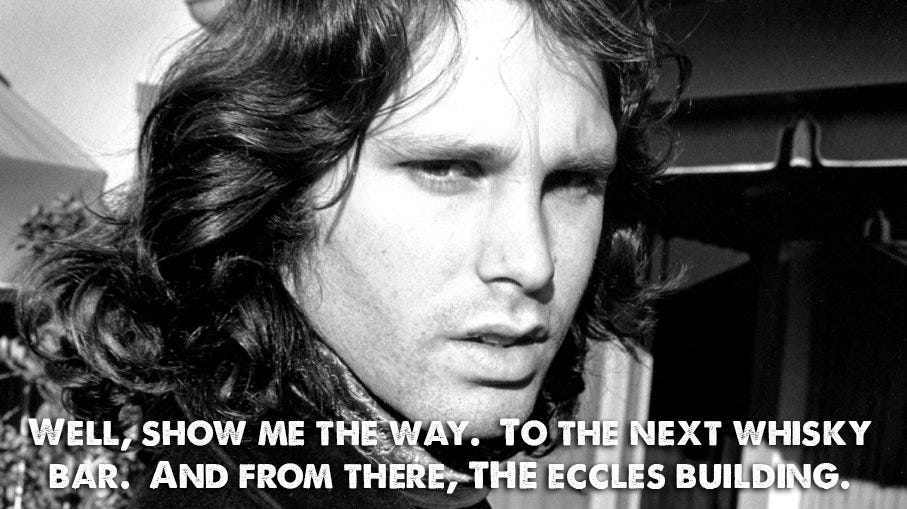

Geez… I am not sure about Moore’s claim, but when I googled “sycophant” I was surprised to find some contradictory evidence:

If Stephen Moore gets approved for the FOMC Board, the transformation to full rock-star-madness will be complete.

Now don’t misunderstand what I am saying. I am making no judgment about the correct course of monetary policy. My job is not to determine what should be, but rather determine what will be.

The Fed’s flip-flop during the past four months has been nothing short of astounding and this latest development is just another signal that easy money is here to stay.

Let’s stop to think about Moore’s claim that the Fed should “immediately cut 50 basis points.” In the past when the Fed cut more than 25 basis points it was due to a market crisis. Last I looked the S&P was up 12.5% year-to-date, credit spreads were behaving well and on the whole, financial conditions were relatively easy. From an economic perspective, employment is chugging along nicely and although growth could be better, the United States is still putting up decent numbers.

It’s into this environment that the Fed should immediately cut 50 basis points? Sure, Stephen - have another drink.

I am not a huge Taylor Rule fan (I think it places too much emphasis on the Phillips curve), but traditional economists rely on it as a broad indicator of whether monetary policy is tight or loose.

The bottom panel represents the deviation from the rule. What I think is interesting is the period from March 2004 to May 2006. It was during this period that Greenspan (and then Bernanke) was raising rates 25 basis points every meeting in their measured pace. The slowness in closing the gap between easy monetary policy and what the Taylor rule was indicating as the proper price of money is generally viewed as a main factor in the mid-2000s market bubble.

Yet look at the current level of monetary accommodation. Fed funds are still 250 basis points too low according to this model!

But Stephen Moore wants even lower rates…

This party is getting crazy - next thing you know, Trump and his entourage will be banned from Holiday Inns throughout the world…

Thanks for reading,

Kevin Muir

the MacroTourist

PS: For those too young to recognize all these rock legends, I recommend you spend some time learning how Keith Moon from the Who was given a global lifetime ban from Holiday Inns for driving a car into a swimming pool. Here is a quick recap of Keith’s night.