Sell the Loonie against Everything

Canada's bond market is sending a clear signal

I am getting more bearish on Canada every day. And it's more than the fact that we must be suffering from hockey-hyperinflation if sticks now cost $300 each.

Over the next few weeks I plan to sketch out all the reasons I am negative on Canada's economy, but today I would like to focus on the signal the bond market is sending.

Before I do, I would like to take a moment to stress that although I am bearish on Canadian financial assets, that doesn't mean that I am a self-loathing Canadian. I am in fact a loyal Canadian who wears a toque and pronounces it Zed, not Zee.

It often frustrates me how people interpret market calls as reflections of a market pundit's views of that country or people. For example, I believe US stocks are priced for perfection relative to the rest of the world and don't represent a favourable long-term risk-reward opportunity. Does that mean I am judging America's economy or people? Not even for a moment. I am simply calculating what I believe the market has priced in, and then evaluating those expectations versus what I believe to be the actual odds of that outcome occurring. Too often this nuance is lost. Don't ever forget that this game is not about predicting what will happen in an absolute sense, but what will happen versus what is priced in.

Back to Canada. I'm bearish. Bigly. And I am not one of those perma-bears who for the past six years has been calling for a collapse in Canadian real estate ala a repeat of the US experience during the Great Financial Crisis. In fact, for most of 2019 one of my favourite trades was short AUDCAD [Best Way to Short China] as a I believed Canada's economy would outperform Australia's.

But the tide has turned. Although Canada has a reputation as a beacon of financial stability, there is one Canadian asset class screaming danger. Yet it's funny because almost no one is talking about it.

The signal from the bond market

Remember all the hype about the US yield curve going negative this summer? You couldn't turn on financial news television without being bombarded with "RECESSION WATCH FROM YIELD CURVE INVERSION" headlines.

Almost overnight it seemed like everyone became a yield curve expert. The economic signal that had correctly predicted the past six recessions was flashing a warning, and gosh darn, the bears were going to run with this story as best they could.

Yeah, this summer was scary. But then something happened...

With little fanfare. With no announcement that recession-watch had been cancelled. With zero acknowledgement the hype might have been overblown, the 2-10 yield curve snapped from negative levels and ran 30 basis points higher in the space of two months.

Was that a valid signal? Is this the steepening that has traditionally occurred during the onset of recession? That's a story for another day, but there has been an interesting development in the developed world's bond markets since this summer's yield curve mania.

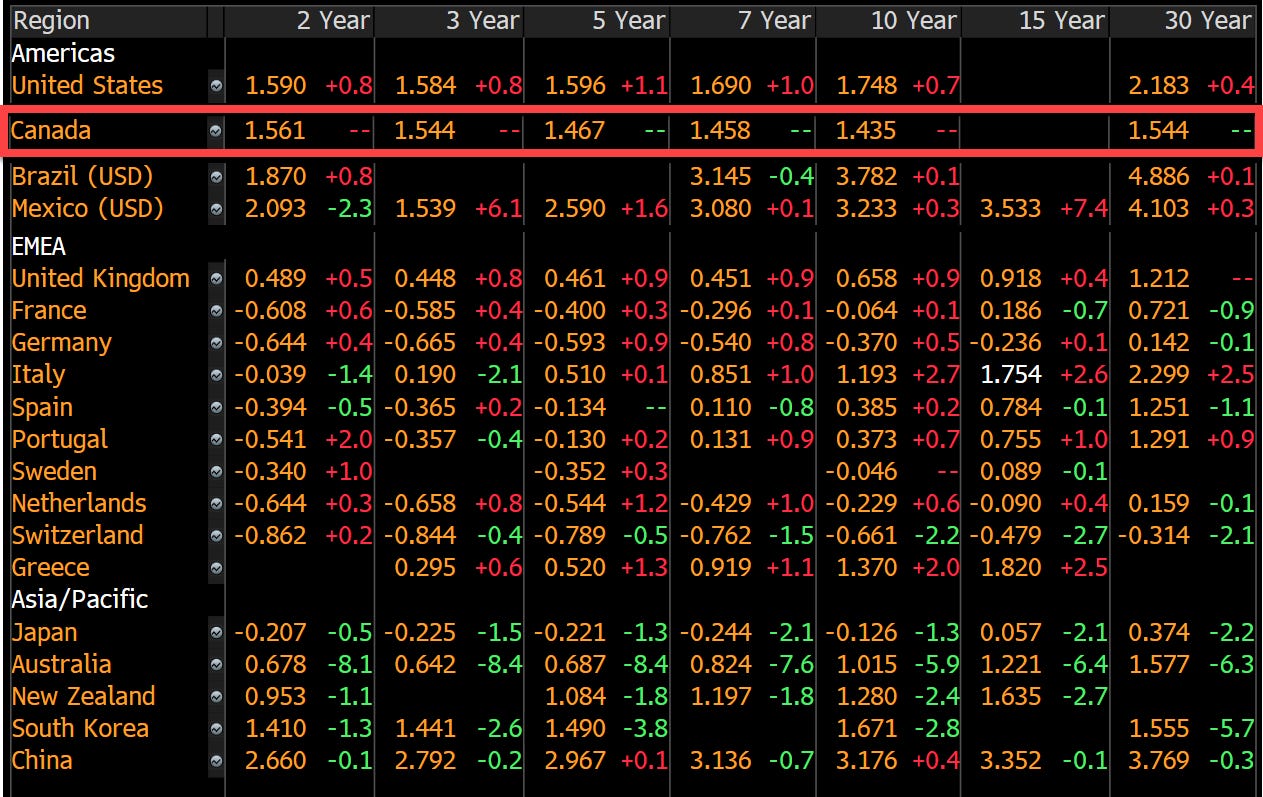

Can you spot it?

There is only one country with an inverted yield curve. That's right - Canada.

Canada's yield curve dipped negative this summer along with its larger southern neighbour, but instead of bouncing straight back up, it has failed to cross back positive.

If you are a US recession-believer due to this summer's yield curve signal, then you should be doubly bearish on Canada! Not only did the same trigger occur, but it has failed to be rejected. Here we are with the yield curve sitting at inverted levels and yet most market pundits are still blindly optimistic on Canada's prospects.

I have a whole laundry list of reasons why Canada's economy will underperform expectations (more in coming posts), but don't listen to me - listen to the bond market. It's sending you the ultimate BE CAREFUL signal.

To all those pundits who tell me that Canada is different and isn't susceptible to the same economic forces as the rest of the world because of our;

well-run banking sector

immigration policy

strong-rule-of-law

insert-whatever-bullish-Canada-story-you-want-in-here

I call BS on that. Yeah, I still drink Labatt's and say sorry too often - I AM still CANADIAN, but the loonie is a great sale against almost any other developed country on the board.

Thanks for reading,

Kevin Muir

the MacroTourist