POLOZ AS THE CANDYMAN

(and no, not the kind Christina Aguilera sings about)

Want to know my favourite type of celebrities? The ones who can laugh at themselves. Most take themselves way too seriously, but every now and then a fellow like Wilford Brimley scrolls across my twitter feed. For those who don't know Wilford, he did that infomercial about diabetes and has been the butt of jokes ever since. Not one to shy away from the comedic opportunity, Wilford recently tweeted out the following picture:

Now at this point you are probably asking "what does this have to do with the markets?"

Good question. The inspiration comes from a recent question that BNN Bloomberg reporter Andrew Bell posed to Bank of Canada Governor Stephen Poloz:

"In your speech today you said that the high household debt load is the most important risk facing the financial system, but aren't you the man whose to blame for that? You're the CandyMan. You kept interest rates so low all those years. You're the main author of that bubble, aren't you?"

I felt like it was an somewhat aggressive assertion on Andy's part. Hats off to you Andy for holding his feet to the fire. Poloz can't lecture us about household debt when his interest rate policies helped fuel the Canadian consumer debt orgy.

But calling him the Candy Man? Bold play. Guttiest move I have saw man.

Now Andy, I am not sure how old you are, but I am assuming you were referencing Jerry and the boys' version of CandyMan:

And not the more likely millennial version by Christina Aguilera because I don't think Poloz wants to be known as that sort of CandyMan:

How did Poloz take your question? Well, after collecting his thoughts, he defended his actions in typical Central Banker fashion:

For those who don't want to watch the response, I have transcribed Poloz's comments:

Well, ummmm, a lot of things may have contributed to it Andy. Certainly I would say that keeping interest rates low, as many countries have had to do, for over ten years now, if we go back to 2008,9, 10, we had a lot of fiscal action at the same time as monetary stimulus. And then globally, we saw enough of a recovery at that time in 2010 that governments decided - ok, we have things back on track so we can start consolidating the fiscal side and monetary policy makers figured we'd be coming out of it too.

But then the whole economy faltered again, and we had that period we call the serial disappointment and it's in that phase that monetary policy got stuck in a very stimulative place offsetting the headwinds that are really hard to quantify by conventional analysis. They are obviously there even though the Canadian economy is at full employment (more or less) and inflation is on target. We're there, but with really low interest rates still (from a historical standpoint). So those low interest rates are still stimulating against some contrary force.

So, uhh, I mean the fact that inflation is on target today suggests the Bank of Canada has done its job. Now if there are side effects, one of them that you are mentioning, well those are secondary effects. They are not our prime mission. Our prime mission is to stabilize the economy and keep inflation on target. And we succeeded with that.

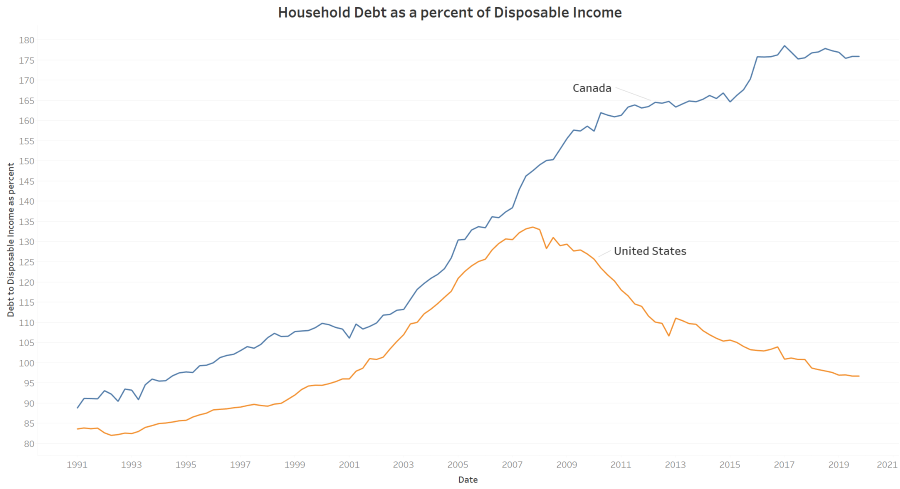

Now this might be what Stephen says to himself so he can sleep at night, but here is the chart of Canadian consumer debt versus our American cousins.

I am calling bullshit on the idea that we didn't blow a monstrous household debt bubble. Maybe it won't collapse in on itself - I can buy that. But Andy was spot on when he called Poloz the CandyMan.

I am not here to judge whether the policy was correct or not. If I had been the Bank of Canada Governor during this period, I too probably would have handed out the candy.

Yet it's important to realize the Canadian consumer is stretched thin. The typical American household is in such better shape. That's why I love US homebuilders and am shorting the Canadian banks.

Stephen Poloz is scheduled to step down as Governor soon, and although his replacement will most likely continue with the candy, I worry the Canadian consumer is stuffed so full of the sugary stimulant, they are about to pull away from the table and head for a nap. Trade accordingly.

Thanks for reading,

Kevin Muir

the MacroTourist