ONCE A CAVER, ALWAYS A CAVER

Remember the Powell of last year? You know, the one that tried to convince us that there “could be no macroeconomic stability without financial stability?” And this Powell was not concerned about financial stability in terms of making sure the stock market never went down, but rather just the opposite. On June 20th, 2018 Powell brought to our attention that;

“Indeed, the fact that the two most recent U.S. recessions stemmed principally from financial imbalances, not high high inflation, highlights the importance of closely monitoring financial conditions.”

For the first ten months of his stint as Fed Chair, Powell articulated a position of discipline and tried to back away from the idea that Wall Street was dictating monetary policy. Powell repeatedly stressed that rates would be set for the long-run benefit of the economy - not for the desire of the money markets. In fact, even as late as the FOMC meeting on December 19th, 2018 Powell was trying to convince the world that stock market gyrations would not shift his resolve:

“What matters for the whole economy is material changes in a broad range of financial conditions that are sustained for a period of time. A little bit of volatility – speaking in the abstract - some volatility doesn’t probably leave a mark on the economy.”

And this was consistent with his message during his tenure as a Fed governor. From the WSJ:

At the Fed’s January 2013 meeting, then-governor Jerome Powell warned about the growing market distortions created by the Fed’s ongoing asset purchases, pointing to “many examples of bubble-like terms,” including in fixed-income and leveraged-finance markets.

“I do think that the incentives will rule in the end, and the incentive structure that we put in place with the asset purchases is driving securities above fundamental values. So there is every reason to expect a sharp and painful correction.”

He also said he agreed that financial-stability risks were a job for regulatory policy, not monetary policy, but suggested policy makers should be clear-eyed about the effects of monetary policy - and bond-buying in particular -on financial stability.

“We need a more robust knockout for financial stability in connection with low rates,” he said. “We know that long periods of suppressed volatility can lead to the buildup of risks and to a disruptive ending, and the idea that monetary policy can ignore that and leave it to macroprudential tools just is not credible to me.”

The remark suggests that, at least in 2013, Mr. Powell favored using monetary policy to address imbalances in financial markets rather than relying solely on regulatory policy.

This used to be Powell’s message - stock market swings won’t change the Fed’s view.

Funny how things change when Powell is staring down the barrel of a stock market decline that seemed to be spiraling out of control (this time not as a Fed governor, but rather the Chairman). The late December swoon proved too much for Powell to bear, and since then he has folded like a lawn chair on almost all of his hawkish guidance.

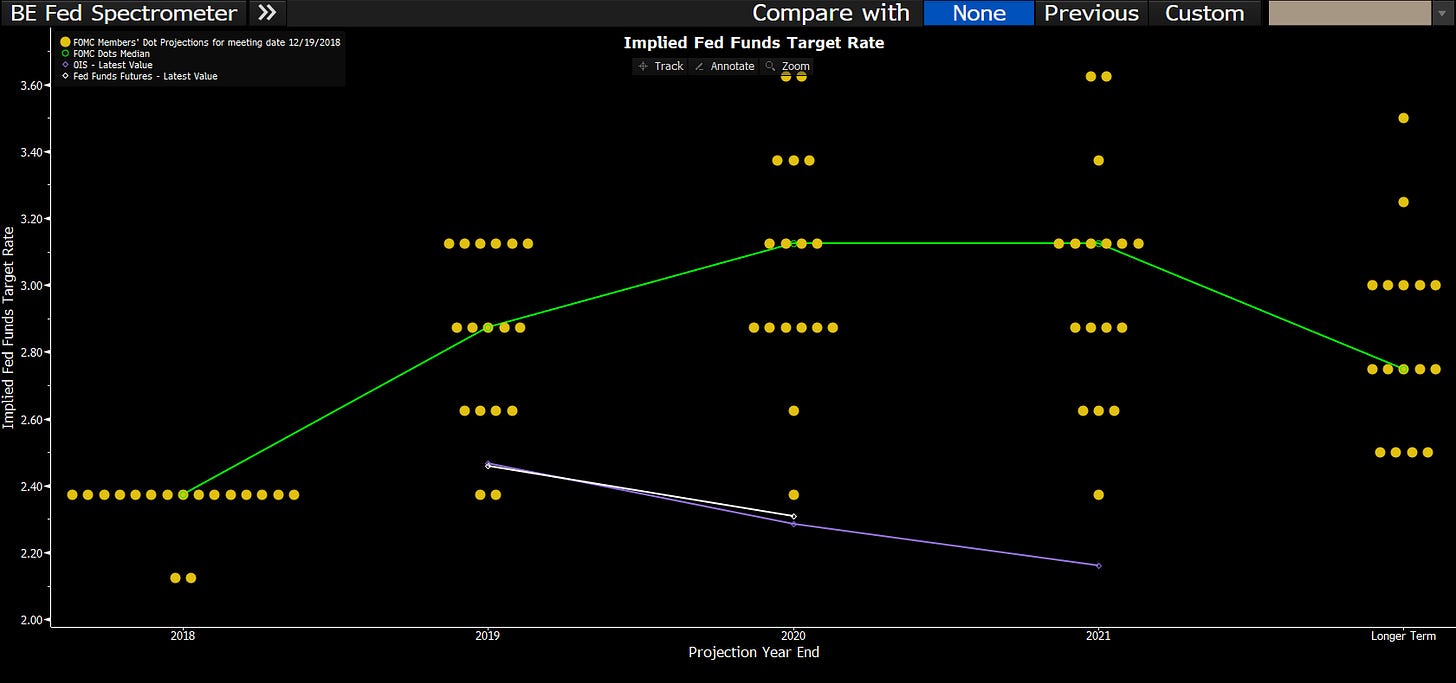

Gone is the idea we are a “long way from neutral.” Even though the FOMC “dot plots’ that are supposedly the Fed’s guidance as to future rate policy are indicating expectations of a much higher Fed Funds rate, Powell has completely given up trying to convince the market that this is a realistic expectation. The following chart from Bloomberg shows the FOMC Board Members’ individual expectations of Fed Funds levels along with the purple line which is where the market is pricing future policy.

And Friday marked the last step in his reformation as a true Bernanke/Yellen Fed Chair.

Although Powell had abandoned his October 3rd prognostication that the Fed Funds level was a “long way from neutral”, as late as January 10th he was still holding firm that the Federal Reserve’s balance sheet rundown (quantitative tightening) was on “auto-pilot”. From his interview on that date when asked about the possibility of curtailing QT:

Powell reiterated that the Fed wants to have its balance sheet “return to a more normal level.”

“I don’t know the exact level.“He noted that the balance sheet has declined to about $4 trillion, but that before the 2008 crisis it was below $1 trillion.

“It will be substantially smaller than it is now,” Powell said.

Powell does not want to be adjusting the quantitative tightening schedule as he believes the market has already priced in the Fed’s prior announcement. The QT tightening program has not been unduly affecting the real economy. Well, Wall Street did not like that. In fact, even Donald Trump got in on the action and criticized Powell for the rundown.

Yet if we go back to Powell’s comments as a Fed governor, he was adamant that this sort of unconventional policy be transparent and credible.

At the Fed’s July 2013 meeting, then-governor Jerome Powell suggested that the “taper tantrum” reflected a “high cost to issuing open-ended commitments.” This led him to roll out what fellow governor Jeremy Stein dubbed the “Powell doctrine.” That is, the Fed should stick to a clear rule for reducing and ultimately stopping asset purchases, starting when unemployment fell to 7%.

“What is important is that we manage the exit from unconventional policy in a credible, transparent and predictable way, guided by the data. It is not going to matter much in the end whether the balance sheet peaks at $4 trillion or $4.25 trillion or $4.5 trillion, or whether we first reduce purchases in any particular month. It is going to matter a great deal that we follow through on our commitments in a credible way.”

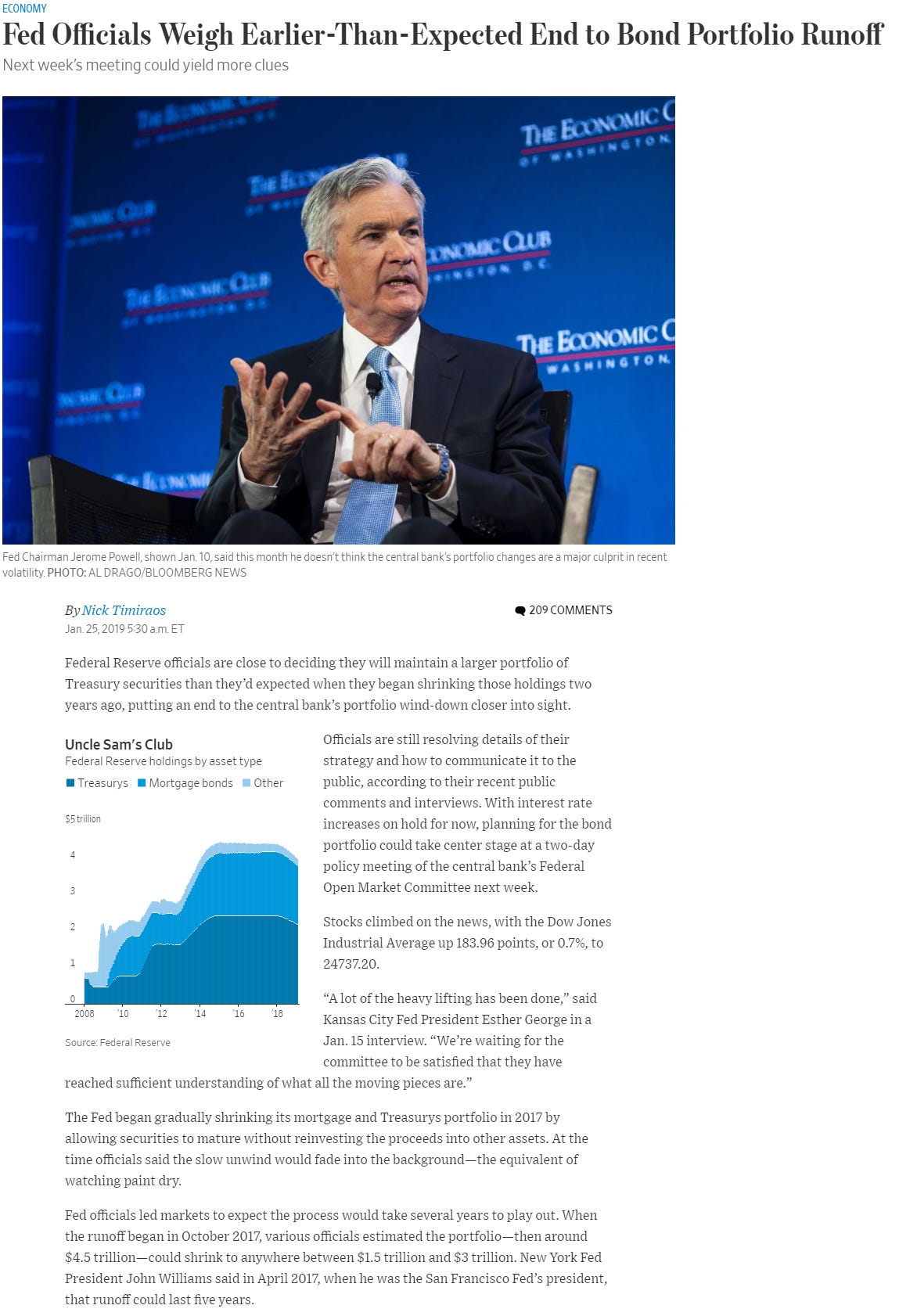

It looked like Powell might hold tough, but Friday the Wall Street Journal published an article that was widely viewed as the first step in the FOMC changing QT policy.

The Federal Reserve has a long history of leaking information to the market through a senior reporter at the Wall Street Journal. Given that the Fed is currently in a black-out period, the market took this WSJ report to be a deliberate leak from the Fed to prepare the market for a change in policy regarding the balance sheet.

There are some who suggested this was a trial-balloon to judge the market’s reaction to a potential shift. To me, this idea makes little sense. If the Fed doesn’t know that the market would love the idea of the QT program being cut back, then they have no business running monetary policy.

Of course the stock market took off and the US dollar sold off. Even my grandmother was buying on that news.

But the real question is why? Why bother leaking this information? It doesn’t seem to make any sense.

Which leads me to three different possibilities:

Powell somehow believes that surprises are bad and that it is important for the information to be eased out into the market. I guess that might be the case if you are talking about bad news, but it seems to me that good news should be ripped off like a band-aid. But hey - I don’t have an army of PhD economists telling me the optimal method of communicating my waffling, so I don’t know. Maybe this is just messed-up Fed thinking at work.

Maybe the WSJ has gone rogue and this story is not a leak but merely the “connecting of dots” from previous Fed communication. If you look carefully, there is little new information.

Someone - either another faction at the Fed or maybe even the White House - planted the story in an attempt to force the Fed to change QT policy.

I know the last two options seem a little extreme.

But I would like to point out that if Powell had not recently caved to Trump and Wall Street, the market would not be so quick to believe this sort of article. The reason it was taken so bullishly is that lately Powell has been giving the market what it wants.

So if he didn’t plant that article, Powell now finds himself in an awkward position where not following through with a change in QT will have an outsize negative affect on the market.

After all, the market believes - once a caver, always a caver.

Thanks for reading,

Kevin Muir

the MacroTourist