LET'S BE CAREFUL OUT THERE

I hope I am wrong about this one...

I don't like trafficking in end-of-the-world predictions. On the whole, humans tend to figure stuff out, so I am by no means a doomsayer. In fact, the market often worries too much about imaginary disasters, so usually I am on the side of calling for calm.

Yet there is sometimes a potentially worrisome situation that the market seems to ignore. Or at least ignores for a while. Then in a sickening whoosh, the worse case scenario gets discounted.

I sure hope I am wrong about this next development. Nothing will make me happier than to be proven the little-boy-who-cried-wolf.

However, I think it is an important enough development to bring to your attention as the market seems to be almost completely ignoring a serious development in the Chinese swine flu crisis occurring in the central Chinese city of Wuhan.

From a Reuters article titled "As virus spreads to more Chinese cities, WHO calls emergency meeting":

BEIJING (Reuters) - An outbreak of a new coronavirus has spread to more Chinese cities, including the capital Beijing and Shanghai, authorities said on Monday, and a fourth case has been reported beyond China’s borders.

China’s National Health Commission confirmed that the virus, which causes a type of pneumonia, can pass from person-to-person, the official Xinhua News Agency said.

President Xi Jinping said curbing the outbreak and saving lives was a top priority as the number of patients more than tripled and a third person died.

Adding to the difficulties of containing it, hundreds of millions of Chinese will be traveling domestically and abroad during the Lunar New Year holiday that starts this week.

Authorities around the globe, including in the United States and many Asian countries, have stepped up screening of travelers from Wuhan, the central city where the virus was first discovered.

“Wuhan is a major hub and with travel being a huge part of the fast approaching Chinese New Year, the concern level must remain high. There is more to come from this outbreak,” said Jeremy Farrar, a specialist in infectious disease epidemics and director of the Wellcome Trust global health charity.

Authorities confirmed a total of 217 new cases of the virus in China as of 6 p.m. local time (1000 GMT) on Monday, state television reported, 198 of which were in Wuhan.

The virus belongs to the same family of coronaviruses as Severe Acute Respiratory Syndrome (SARS), which killed nearly 800 people globally during a 2002/03 outbreak that also started in China.

I claim the market was underestimating the potential of the flu spreading, but I should really qualify that with an "until today."

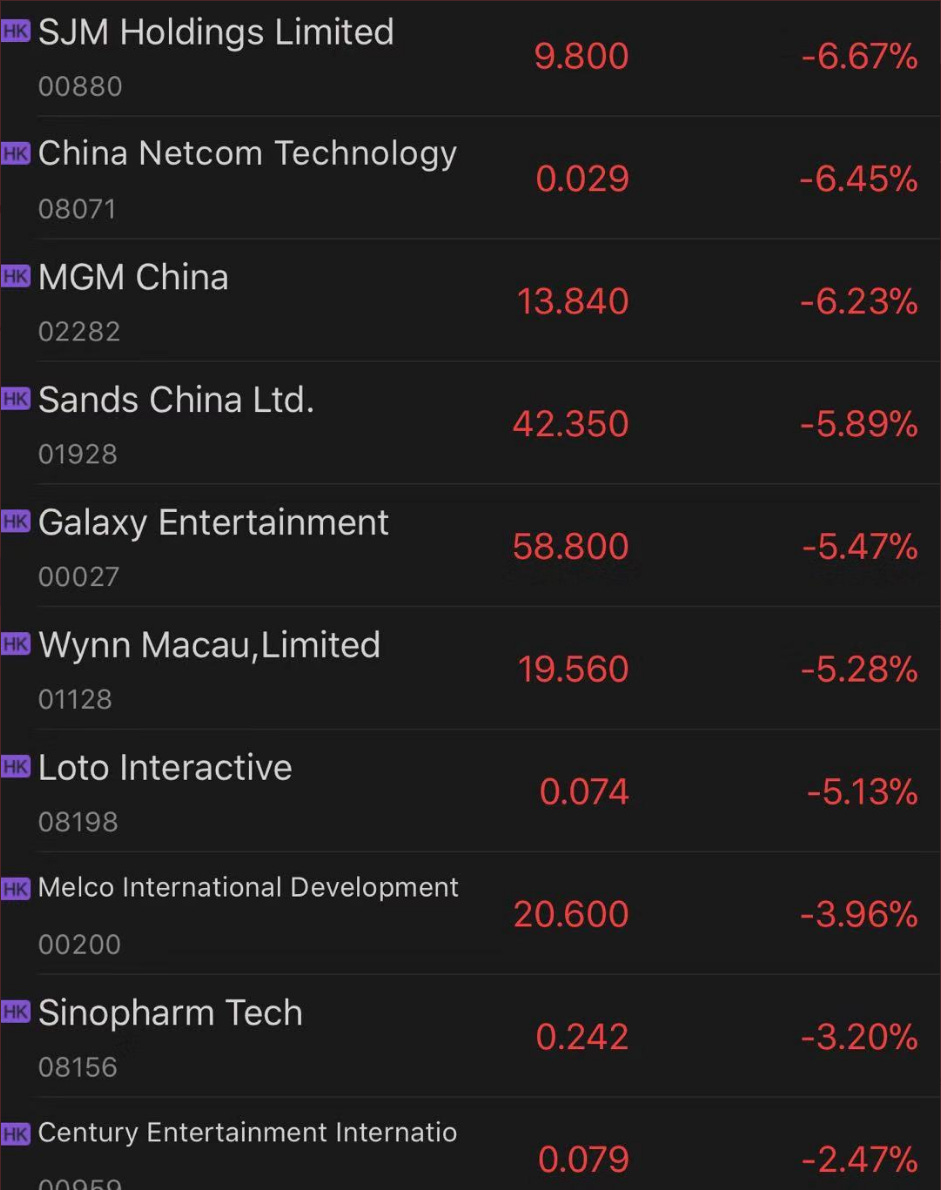

Hong Kong casino stocks were hit hard and pharmaceutical firms were bid strongly in Monday's trading. Anecdotally there are reports of N95 face masks trading at 3x retail price.

I guess that's what calling a WHO Special meeting does. It causes markets to sit up and notice.

Will this get worse? I have no idea. None whatsoever.

But here is what I know. The market is not ready for this new development. Today was the first day the market showed even the slightest bit of concern. And my guess is that today will prove the start of a growing worry, not the other way round.

I have no way of monitoring this situation. Let's face it - it's China - so no one really does. But a savvy overseas market veteran pointed me to this twitter account:

Another good resource is Yuan Talks:

I would like to repeat - I am usually not one to hit the panic button. But this is a case where the market has underappreciated the possibility of this situation getting worse.

Let's just all remember to be careful out there.

Thanks for reading,

Kevin Muir

the MacroTourist