IGNORING BREAKEVENS

This has been a crazy month and I have a lot to say, but I want to get this post out before the Fed’s announcement, so it will be a short one.

It’s been a long time since the outcome of a Fed meeting hasn’t been a foregone conclusion. It’s shocking how quickly market participants have gone from “of course the Fed will hike this month” to “the Fed should take a pass”.

Famed strategist David Rosenberg’s recent shift sums up this attitude:

I don’t know if the Fed will skip this hike or not. I can make the case both ways, but I do think the market has talked itself into believing the Fed will err on being dovish, so the bar has been raised for Powell’s performance.

Yet Rosie’s comment got me thinking. There is no doubt that inflation expectations have collapsed over the past two months. And crude oil’s demise was definitely one of the driving factors.

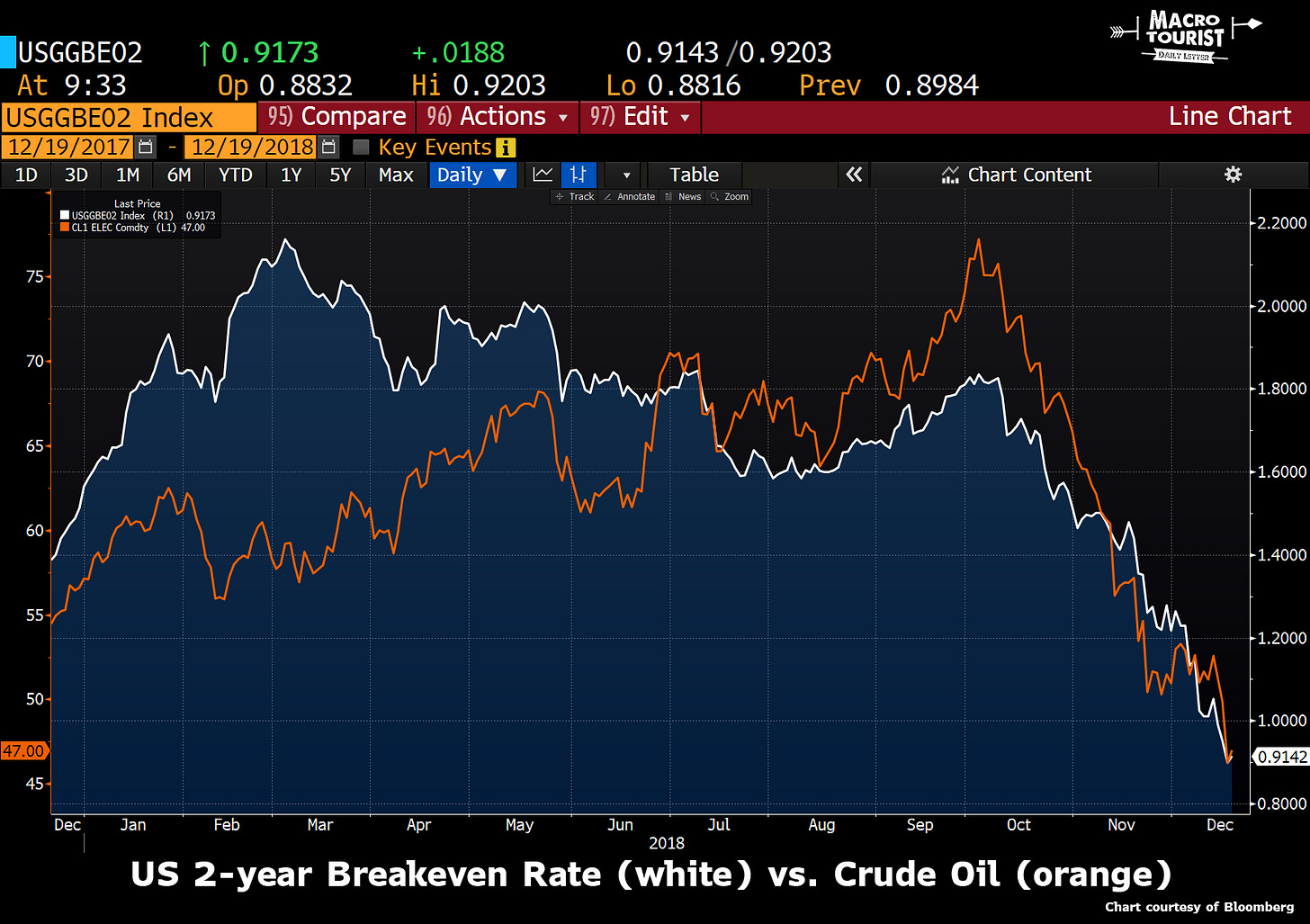

Have a look at this chart of the 2-year breakeven inflation rate versus crude oil.

The 2-year breakeven inflation rate has collapsed from 1.80% in September to 0.91% today. The market ha squashed inflation expectations over the next two years by almost 90 basis points. That’s a big move.

I understand why Rosenberg believes the conditions might be ripe for the Fed to take a pass. Why tighten into crashing inflation expectations?

But is he correct about the Fed’s past behaviour?

He is right that the FOMC has never tightened into an oil decline of this magnitude, but what about inflation expectations?

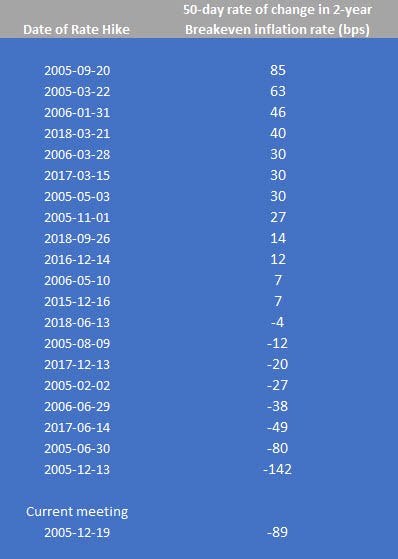

Unfortunately TIPS (Treasury Inflation Protected Securities) have not been actively trading for long enough for us to get a robust dataset, but this tightening cycle and a good part of the previous one have decent enough data for us to get a feel.

So let’s dig into the data:

The majority of the rate hikes had seen increases in 2-year breakeven rates, but look at 2005. This sort of tightening-into-collapsing-inflation-expectations is far from unheard of.

During the early 2000’s tightening cycle, the Fed did in fact tighten into a period when inflation expectations had fallen by more than the current decline.

Will that mean the Fed goes ahead with this tightening? Not sure. I am torn about how they will stick-handle this situation. But I will say one thing - they have ignored breakeven signals in the past, and if the hawks have their way, they might do so again.

Thanks for reading,

Kevin Muir

the MacroTourist