SOLD TO YOU STANLEY!

Every year since 2000, Warren Buffett has auctioned off a private lunch where the proceeds go to the Glide charity. This year an anonymous bidder paid a little more than $4.5 million for the privilege. My favourite part of this story? The first buyer purchased the lunch for a paltry $25,000! Talk about scooping up a pre-IPO cheap private placement for pennies on the dollar!

Here is the list of different buyers throughout the years:

2000: Pete Budlong, $25,000

2001: Jim Halperin and Scott Tilson, $20,000

2002: Jim Halperin and Scott Tilson, $25,000

2003: David Einhorn, Greenlight Capital, $250,100

2004: Jason Choo, Singapore, $202,100

2005: Anonymous, $351,100

2006: Yongping Duan, California, $620,100

2007: Mohnish Pabrai, Guy Spier, Harina Kapoor, $650,100

2008: Zhao Danyang, Pure Heart Asset Management, China, $2,110,100

2009: Courtenay Wolfe, Salida Capital, Canada, $1,680,300

2010: Ted Weschler, $2,626,311

2011: Ted Weschler, $2,626,411

2012: Anonymous, $3,456,789

2013: Anonymous, $1,000,100

2014: Andy Chua, Singapore, $2,166,766

2015: Zhu Ye, Dalian Zeus Entertainment Co, China, $2,345,678

2016: Anonymous, $3,456,789

2017: Anonymous, $2,679,001

2018: Anonymous, $3,300,100

2019: Anonymous, $4,567,888

Although I understand the attraction to speaking privately with the cherry-coke-loving octogenarian, my dream lunch wouldn't be with Warren. No, if I could pick one person's brain, without a doubt, it would be who I consider the best trader/investor of all-time - Stanley Druckenmiller.

There is little need for me to rehash why Druck is so good. Take the time to read about his exploits with Soros. Or look at his record since going on his own. The consistency and return versus humility is off the charts!

It is therefore with great zeal that I devoured his recent hour long interview with Bloomberg's Erik Schatzker.

It happens that Druck's views coincide rather neatly with my forecast for increasing inflation, but instead of rehashing his arguments, I think it would be more helpful to highlight where I differ.

But before we do that, let's recap Druck's framework that he is working with in this environment:

Well, you have very low unemployement here [in the U.S.]. You have fiscal stimulus in Japan. You have fiscal stimulus and a lot of confidence coming to Britain. We are running a trillion dollar deficit at full employment. Apparently we are going to have some sort of green stimulus in Europe. And we have negative real rates everywhere, and negative absolute rates in a lot of places.

So with that kind of unprecedented monetary stimulus relative to the circumstances, it's hard to have anything other than a constructive view on the markets, risk and the economy in the intermediate term. So that's what I have.

That's why I love Stan. He doesn't let his view about what should be done (which is rather clear that he thinks the US government should trim spending and try to balance its budget) interfere with what is being done.

Druckenmiller is of the opinion that Central Banks, and even more importantly (at least in my opinion) governments, are stimulating so it's foolish to fight the wave of liquidity. He also believes that easy monetary policy means you should be short long-dated fixed-income - something I wholeheartedly agree with!

However, instead of fawning all over his market calls, let me highlight where I think he is mistaken. Now, far be it from me to fade Druck, but I think he would be the first to tell me that he "has no monopoly on the truth."

Druck is bullish on commodity currencies such as Australia, New Zealand and Canada because he sees a global reflation occurring. If you look back in history, this positioning would be correct. However, I worry about using the old playbook in this new environment.

The other day when I wrote my bearish CAD piece [SELL THE LOONIE AGAINST EVERYTHING], the main pushback was; "why would you want to be short a commodity currency into a growing global economy?" I understand this view. And that's the same logic Druck used.

But this is a case of investors looking too broadly and not examining the country specific issues.

I have previously promised you a follow-up on more reasons to be short CAD. No denying that I have fallen down on this commitment, but let me give you a teaser right now.

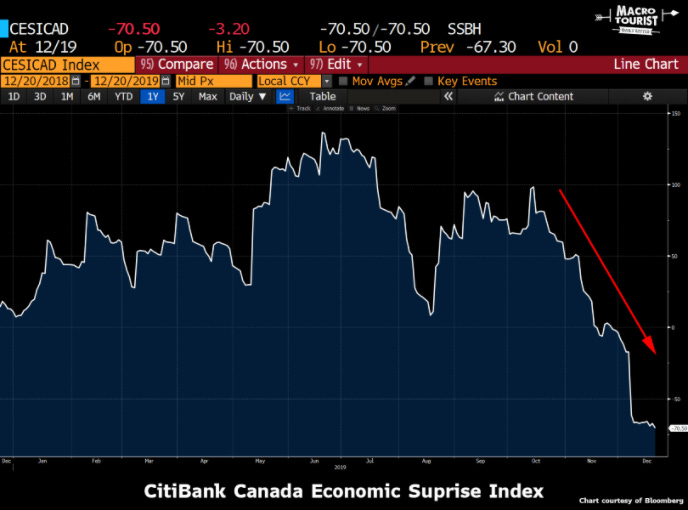

Here is the CitiBank Economic Surprise Index for Canada:

Even though the global economy is improving, Canada has her own country-specific problems.

When you examine the relative performance of the US/Canadian economy vs expectations, it is clear things are improving in the United States, but Canada is getting much worse.

I have been puzzled by the action in the Canadian dollar lately. It's been rallying in my face irrespective of the poor Canadian economic numbers.

I am beginning to understand why. Investors like Druckenmiller are buying the Loonie as a global reflation play.

Although Druck is my hero, I am not scared of taking the other side of my idol's trade. So in the most respectful way possible, all I have to say to Stanley is "sold to you!"

Thanks for reading,

Kevin Muir

the MacroTourist