HEADLINES ARE SELDOM WHAT THEY SEEM

Last Friday, the Wall Street Journal hit the send button on a controversial article highlighting the monstrous S&P 500 and Eurostoxx put option position that had been amassed by the world's largest hedge fund - Bridgewater Associates.

Bearish traders were quick to point out that even if the fund was not net short stocks, buying put options in this size was certainly not a bullish sign.

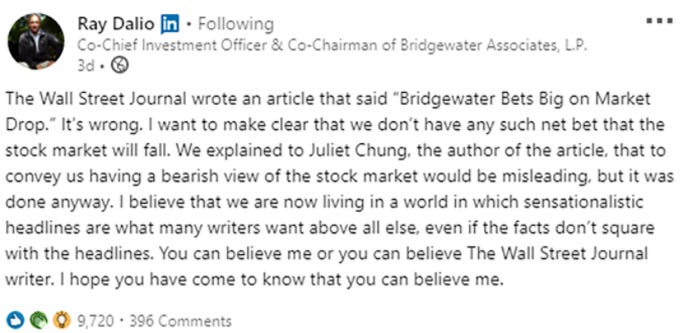

Even when Bridgewater founder Ray Dalio took to LinkedIn (I know, LinkedIn?) to refute the article, it offered little comfort to these half-empty folks.

I wasn't going to even mention this development until my pal Barton_Options brought up a great point that I had completely missed.

Bridegwater's main strategy is something called Risk Parity. This investment philosophy believes in weighting asset classes by volatility. Why treat stocks and bonds the same when stocks are significantly more volatile than bonds? It makes more sense to create a portfolio where asset classes are adjusted to equalize volatility.

When the volatility of an asset class declines, the rules dictate that Bridgewater buys more of that asset. Remember - the less volatile, the more of that asset you need to equal the other assets in the portfolio.

Well, what has the volatility of stocks been doing over the past couple of quarters when Bridgewater has been buying put options?

Volatility has been falling! Therefore, it is actually more logical that Bridgewater has been buying stocks as opposed to betting on them falling.

If you think about a declining volatility environment, it is actually a terrific time to buy a put-protected long position. Yeah sure your puts end up costing more than recent-realized-volatility on a backwards-looking-theoretical basis, but they are still cheap in an absolute sense.

My bet is that Ray Dalio's Bridgewater is far from bearish on stocks. It would make more sense that they are actually relatively overweight equities, but are using put options to limit the downside on their levered long equity position.

Be careful with trading off financial news headlines. More often than not, it's not at all what it seems...

Thanks for reading,

Kevin Muir

the MacroTourist