GUESS WHO'S BUYING?

I’ll warn you right off the bat, I have been waiting to write this piece for the past few days. You see, it’s a gold post, and as much as I try to take a bigger picture view, the trader-in-me still hates writing a bullish piece just as the market is about to have a minor correction. So I often get cute and wait for a dip before I publish.

But the gold decline refuses to materialize and I have decided to just post my piece - hoping I am not top-ticking this recent rally, but fearing it’s probably the surest sign we are headed lower over the short run.

Yet over the long-run, I contend something has changed in the gold market. Something we should all be paying attention to.

Let’s have a look at the trading over the past year. Last November, gold took off and ran from $1,180 to $1,320.

To some extent the initial move of November and December might be easily explained. Don’t forget that during this period the stock market was selling off hard and there was a fair amount of fear in the market.

But why hasn’t gold sold off in the past two months as the fear subsided?

You might argue that gold is simply rallying along with the decline in real yields. Powell’s historic flip-flop has certainly caused real rates to decline and help gold.

However, many market participants believe gold’s price movement is best explained by movements in the US dollar.

For the first three quarters of 2018 gold was indeed trading almost lockstep inverse to the US dollar. The US dollar was going up while gold was falling tick-for-tick.

Since October this relationship has broken down and now both securities are heading higher.

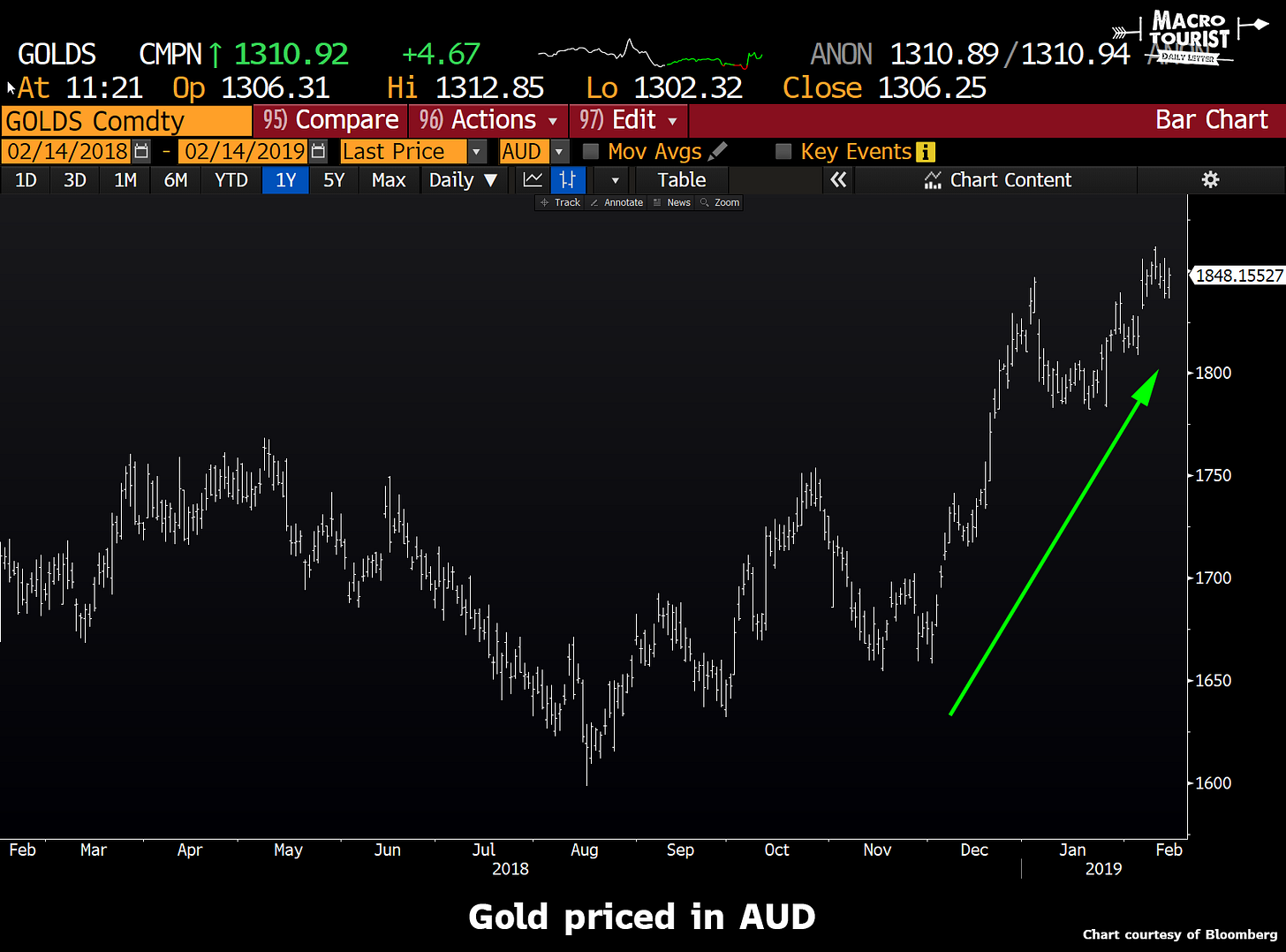

The easiest way to visualize this phenomenon is to show some charts of gold priced in other currencies.

Whether it’s gold priced in CNY, EUR, JPY or AUD, it’s all the same chart - gold has had a strong rally in every currency.

Gold is not going up because of US dollar weakness - it’s going up in real terms.

The question is why?

There is little doubt that the dovish tilt by Powell has helped gold, but if you look at when the rally started, it was way before his post-Christmas cave.

I don’t have any wonderfully original insights to present to you today. Rather, what little I can offer is to connect some dots and make a guess that the timing is finally lining up for some bigger picture macro trends that have been brewing for some time.

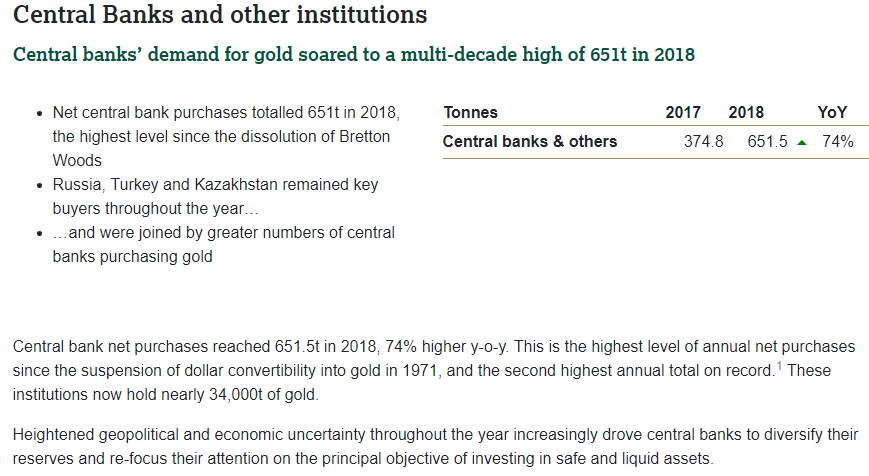

I urge you to read the recent report by the World Gold Council titled “Gold Demand Trends Full year and Q4 2018. From the executive summary:

Look at those figures closely. Central Bank buying up 74% year-over-year! Highest annual net purchases since Nixon closed the gold window! These are some astounding figures that few are talking about. Everyone is blabbering on about every Trump tweet or focusing on the minute-by-minute progress in the Chinese-American trade negotiations, yet right in front of us has been a dramatic shift in the demand picture of the gold market.

My good friends at Murenbeeld & Co. created this great chart for me that shows the net purchases by the Central Banks over the past few decades to get a sense of the scale of the buying.

It really drives home the change in trend. We went from sloppy back-and-forth Central Bank action in the 1970s, to just-get-it-off-the-sheets stupid selling in the 1990s and 2000s, to the recent buy-whatever-is-available-without-driving-the-price-too-high action.

For the past eight years Central Banks have been hoovering gold faster than Lindsey Lohan downs greyhounds at her LL vodka launch party.

And it’s not like this is a small part of the gold supply-demand picture. There are approximately 3,300 tonnes of gold mined each year.

Here is a Bloomberg snapshot of the worldwide demand and supply picture over the past three years:

If we think about the swing from 2005 when Central Banks sold 600 tonnes of gold to last year when they bought approximately 600 tonnes, it’s a demand shift of more than 35% of total supply.

One of the best gold presentations ever created was from Grant Williams. It was titled “Nobody Cares” and I have highlighted it in previous MacroTourist posts.

PIMCO, GOLD BULL? - April 22nd, 2016

THE REAL MESSAGE FROM THE GDXJ MESS - April 19th, 2017

It’s so good I am linking it again and suggesting we all go watch it once more.

Although it was given in 2016, I think Grant’s points are all the more applicable today. In the presentation he goes through the numbers and shows how a little change in demand could have an outsized effect on prices. Grant thought this change in demand would come from investors, but what if he got the entity with the blue tickets wrong? What if it’s not investors who will come for the gold but instead the Central Banks?

I have long postulated that someday the PBOC or the BOJ would come for gold in a big way, and that when that happened, gold wouldn’t be moving by $50s or $100s, but instead would explode higher by $500s or $1,000s. I know that seems preposterous, but stop and think about what the Swiss Central Bank, the ECB or the BOJ have done when it comes to monetizing their balance sheet over the past decade. Do you know what that sort of buying would do to the gold market?

For the past six years gold has been boring.

All the gold bears have been gloating about precious metals’ terrible performance.

I look at it differently. We have had a rip-roaring bull market in risk assets and gold has treaded water. To me, its performance has been encouraging.

The real reason I want to end with that long term chart is that it is easy to think that since we have rallied from $1,180 to $1,310 you have missed the move.

The fact that it is rallying when it shouldn’t only makes the recent moves all the more important. Think about how many long-term gold bulls have abandoned gold and are often now advocating waiting for it to decline to $800 or $900 before loading up the boat.

Well, I don’t know much, but I know that markets seldom make it so easy. To me the hard trade is to buy gold up here. It seems lofty and prone to a pullback. But the best bull markets get overbought and stay overbought.

I think Grant Williams’ theory is finally coming true - he just had the wrong buyer. Just imagine if he ends up being right about the rest of the traditional money management industry chasing gold in a desperate attempt to get even a small allocation to gold. Yeah, yeah, I know. Gold is a barbarous relic that has no economic value. Well, just don’t tell that to the Central Bankers who are loading up their vaults with it…

Thanks for reading,

Kevin Muir

the MacroTourist