"GREEN" BUBBLE CANDIDATES

The other day I asked readers to send in their favourite candidates for what I believe will be the next mania - "green" technology.

When I wrote the original article, "THE COMING GREEN BUBBLE", I mistakenly conflated ESG compliant companies with "green" technology companies. Just to make sure there is no confusion - I am bullish on "green" companies. I realize these companies will most likely also score high on the ESG scale, but it's really the "green" part that attracts me.

Next point - I am late to this story. As the names came pouring in, I realized many of these stocks have already run a long way.

But don't let that get you down. Bubbles always go way farther than most would imagine. I suspect this is early innings.

Not only that, I am pairing this with a short position in FAANGM type names which are over-extended, over-owned and facing fundamental headwinds as society rethinks the role technology plays in our lives. These traditional technology names are often up even more than the "green" names, so on a relative basis, I feel comfortable with this pairs trade.

I am by no means suggesting you run out and buy this "green" list. However, it's advisable to start to get familiar with these stories. The purpose of this post is to help discover some potential names for the next bubble.

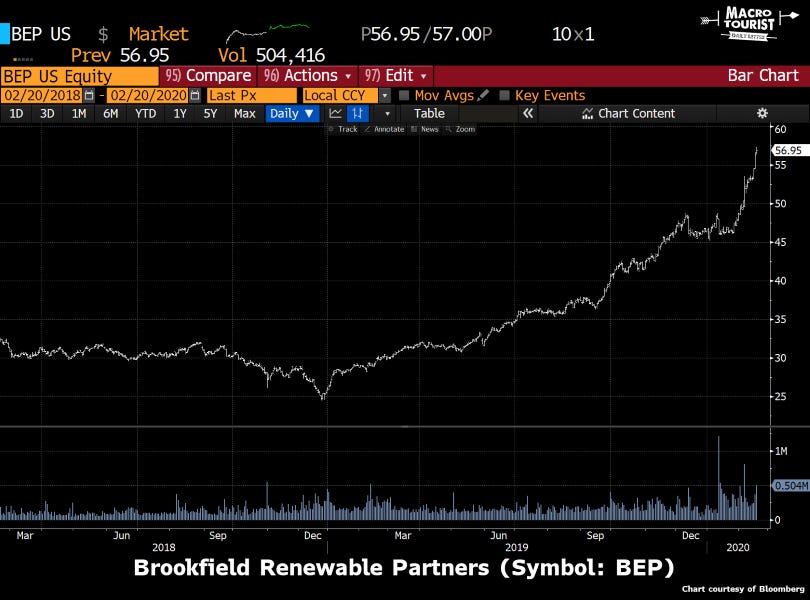

Let's start with my favourite "green" name - Brookfield Renewable Partners (symbol: BEP). No, my partiality is not because the CEO is from my prairie hometown of Winnipeg, but because Brookfield is a superbly well-run shop and ends up being an active manager of renewable assets that will do a much better job exploiting opportunities than I ever hope to.

Now that we have gotten my pick out of the way, let's move on to the reader submissions. Before we start, let me say a big thank you to everyone who shared their thoughts. I really appreciate it.

Without further ado, here it is.

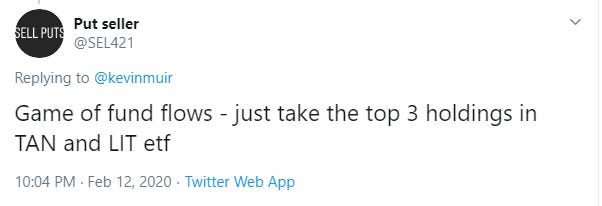

Let's start with my favourite idea. It's from "Put Seller":

I love this idea. Those were two popular ETFs that were often mentioned, but I have included the holdings to foster ideas about individual names:

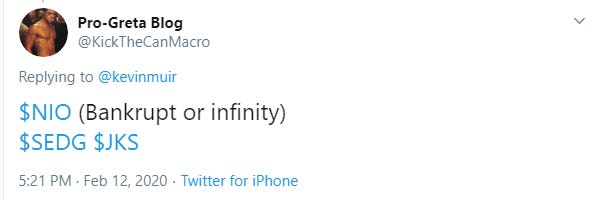

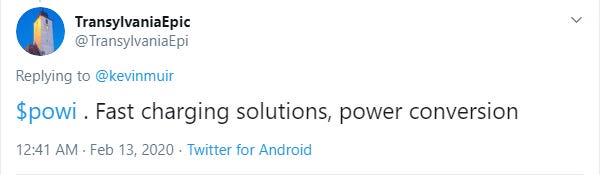

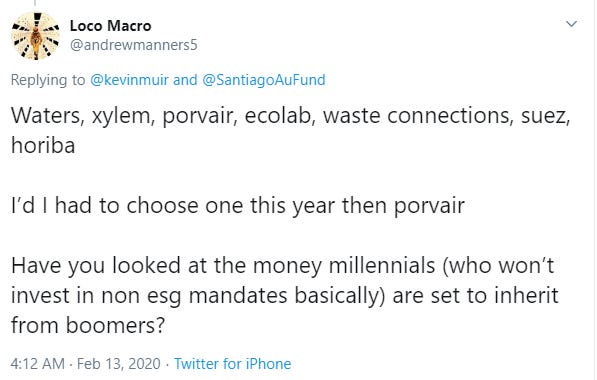

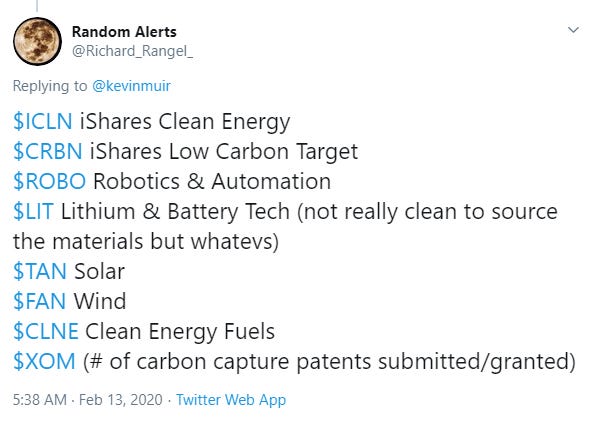

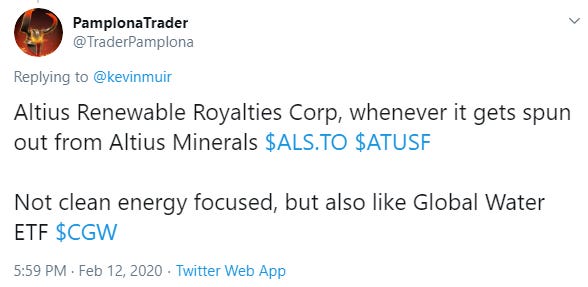

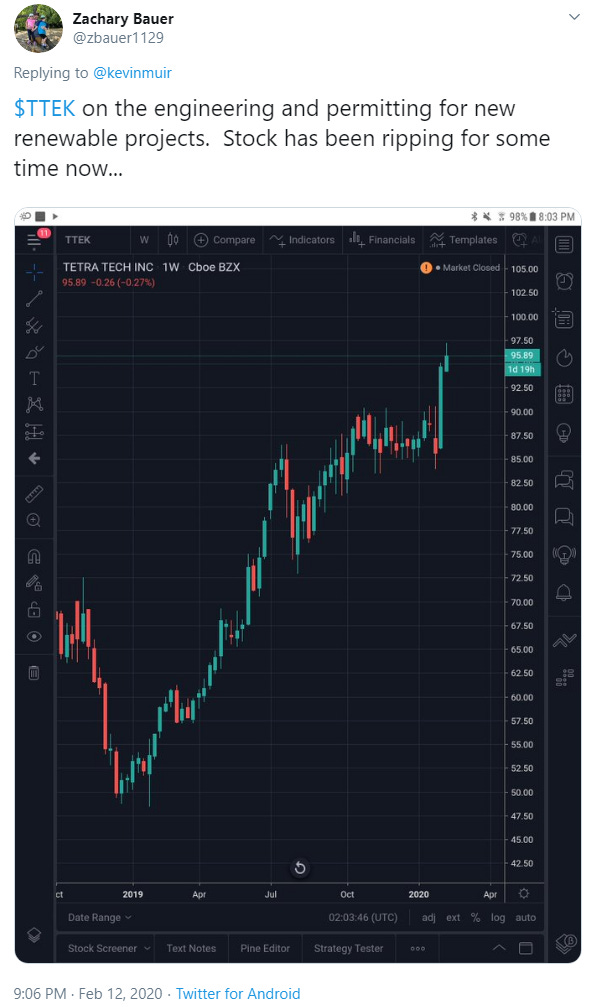

And now, with no real order to the chaos that was my twitter stream, here are some more comments with different names:

There were some folks who preferred the old-fashioned way of email, so I thought I would include a few of those as well:

Hi Kevin,

I have three “green” stocks for you;

Xebec (XEBEF), a Canadian company involved in renewable natural gas; in the sweet spot where ESG and renewable mandates converge. The stock is up a lot, but the future looks bright.

Envision Solar (EVSI), makes a solar-powered EV charger, gaining traction with cities and universities that have EV fleets.

BioHiTech Global (BHTG), technology that converts waste into an EPA recognized solid recovered fuel (SFR) which can be sold as fuel for cement kilns; their process can reduce landfill waste by up to 80%.

These three small companies are on the front lines of the renewables movement. Xebec is further along in terms of revenues, profitability and survivability, but all three are interesting.

Best,

I have two, one bought in May 2019 at €19 (S92.DE), and one recently bought (WCH.DE) at €60 per share. Both are still good to enter, me thinks. Here's what I got into my system on those two.

S92.DE

OPTIONS - QUALITY

From solar energy inverters maker to now full energy service provider: solar inverters for grid connected PV systems; off-grid power supply + backup BYD/SMA battery-storage systems; combine hardware + software into digital energy management solutions (ennexOS platform, SPOT power trading, Design PRO planning); large PV power plants fee based Operational + Maintenance management. 1500 patents. Global solar inverters market leader. Sales EMEA 44→48%, Asia 32→33%, Americas 24→19%. Inverters: 65→75 GW installed, 1,5Mln online portal registered devices= huge data set to analyse + implement new energy management systems + sell new services globally.

Global demand in € terms to be flat till 2021, fierce price pressure largely erode volume growth, till 2021 price stabilization from accelerated market consolidation (many competitors can’t afford to invest in 1. new tech to lower product costs or 2. international expansion to grow faster=they will disappear). With price drop, solar competitive without subsidies in many more markets, govmints then lose ability to control deployment rates, starting megatrend PV energy transition growth, supported by other tech (EV’s, batteries).

WCH.DE

ENTER AT €50 = DOUBLE OR TRIPLE IN 3 YEARS.

SHORT – OPTIONS

Global manufacturer of silicones + water dispersible polymer powder binders and additives. Silicones are used everywhere. 3200 products sold in 100 countries. 24 plants, 15 Labs, 52 subsidiaries. Sales offices in 32 countries. Sales EU 42%, Asia 35%, Americas 18%. Sales: silicones 50%, polymers 26%, polysilicones 16%, biosolutions 4%, others 3%.

1. 1Mln Ton polymers p.a.. Only global supplier of fire-retardant dirt-repellent vinylacetate-ethylene (VAE) copolymer dispersions. In dispersible polymer powders, 2x as big as nearest rival, construction industry main client. Has 50% of global polymer powder market, 30% in VAE dispersion.

2. 2800 silicone products (silane, silicone fluids, emulsions, elastomers, sealants, resins, pyrogenic silicas), leader in EU, global nr. 2. Sales VAE 30%, silicone-based 70%.

3. 70kT p.a. hyperpure polycrystalline silicon powders-to-ingots for wafer making (solar PV cells, semiconductor-electronics), intense competition, decreasing margins, growing volumes from China competitors.

4. Biosolutions=biotech fermentation, 4 plants, gumbase for chewing gum, cyclodextrins, frozen bacteria cell banks, genetically modified live bacteria producing active pharma, food, agro ingredients (cystine, proteins, biosimilars, probiotics, others).

I’ve got two, but I will keep it simple and stick with one I mentioned to you over a year ago, OneSoft Solutions (OSS.V). They use ML/AI to help pipeline operators predict vulnerable spots before they rupture. They are all cashed up with $13 million on the balance sheet and no debt. Six paying customers already including Phillips 66. Kind of ironic that pipelines and ESG can be mentioned in the same breath, but pipes are the most cost efficient and safest way to transport hydrocarbons. The issue is that over 50% of the US pipeline infrastructure is over 50 years old. So while we are clearly moving to an electrified economy, it ain’t happening overnight. In the meantime, there is 2.6 million miles of pipe! Anyways, here’s a few files if you want to dig a bit deeper.

Couldn’t agree more Kevin…its painful…but I’ve sold my energy stocks that trade at 2-3x ev/ebitda and I’ve been buying companies trading at 3x futures sales.

XBC and GRN being the two most recent purchases. I’m told the GRN deal was 2.5x oversubscribed.

NPI, INE, BLX, RNW, AQN – have all benefited hugely from the etf flows recently.

INE was a 95 rsi today before the big print after hours today.

Thanks for reading,

Kevin Muir

the MacroTourist