ELECTION CYCLE STILL INTACT

President Trump is no different than all the others

As the year winds down, I thought I would take a moment to revisit an article from last year.

"Mid-term Election Cycle" was a post I wrote in the days following the mid-term election. In it, I noted that since World War II, there had not been a 3rd-year Presidential cycle that did not see a rise in the American stock market. I know that seems like a shocking stat, but it's true!

I remember back when I wrote the piece, many pundits were bearish. They told me Trump was a different animal. They said the rules didn't apply to him.

Well, I would argue the tendency of juicing-the-economy-in-front-of-your-re-election was probably even more applicable to Trump than all the previous Presidents combined.

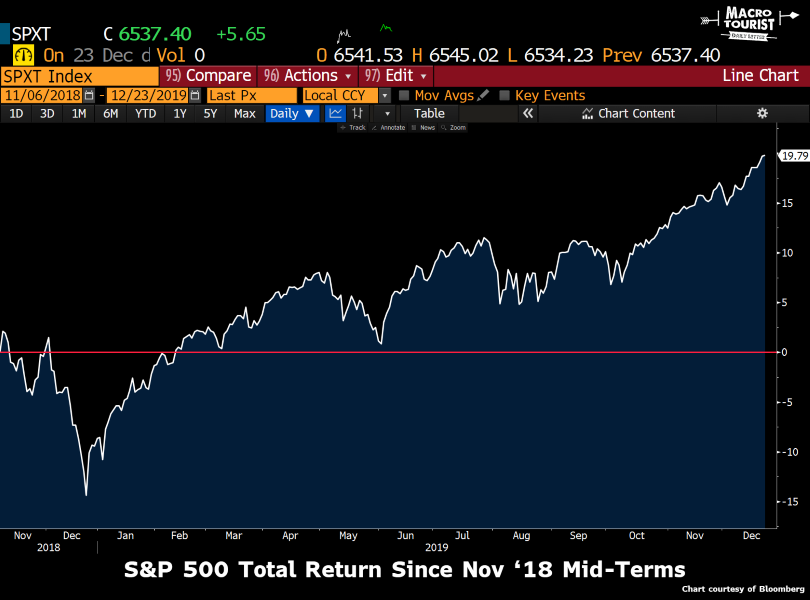

Let's have a look at how the post mid-term election stock market return ended up under the current President:

After a shaky November and December (the measurement started the day after the November 6th, 2018 mid-term elections), the stock market has run like it stole something.

Trump's mid-term election stock market return has been one of the best on record.

But what does all this portend for next year? What does the fourth year of the Presidential cycle look like?

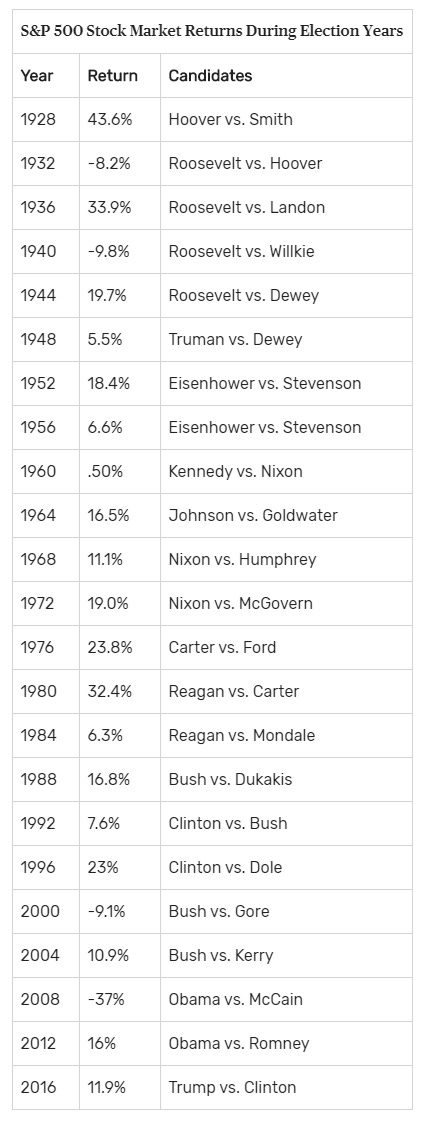

It's the day before Christmas and I have left some shopping to the last minute, so in the interest of time, I am borrowing data from this article - "Stock Market Performance in Election Years" (thank you to the Balance for arranging it so succinctly).

Before we examine the fourth year, remember back to the stat from the third year; since WWII there had never been a down year. The fourth year is also tilted to the positive, but not quite as unblemished. Bush vs. Gore at the turn of the century saw a 9.1% loss. And then 2008 witnessed a blistering 37% decline with the Great Financial Crisis.

Yet what's interesting about both dates is that they coincided with the end of a protracted bull market.

Will 2020 prove the same? It certainly feels like that might be a possibility. But I warn that before those two declines, there had also not been a post-WWII fourth year of the Presidential cycle that had fallen either. From 1948 to 2000, the returns were all to the green side of the ledger.

Perhaps both declines (2000 and 2008) were the result of a Federal Reserve bent on slowing down the economy. With Powell & Co. increasingly looking willing to let the economy run hot, the fiscal pumping from a President (and party) wanting to get re-elected might keep a bid to risk assets.

Yet, as I mentioned yesterday, I don't think the risk-reward favours chasing U.S. stocks up here. I remember a year ago when the Federal Reserve seemed perplexed at the drying up of liquidity. My guess is that the Federal Reserve has been priming the year-end turn a little too hard in fear of a repeat of last year. At the margin, I think January will see less liquidity in the system, and stocks might sag in the New Year. Last year, it was Christmas Eve 2018 when the stock market finally turned. Wouldn't it be something if we topped on the day we bottomed last year?

I don't have any answers except to note that the Presidential cycle that too many people wrote as being different under Trump, was in fact never more relevant.

For everyone who celebrates Christmas - I wish you a Merry One! And to everyone else - Happy Holidays!

Thanks for reading,

Kevin Muir

the MacroTourist