DON'T GIVE AWAY YOUR CRUDE GAMMA

First of all, let me address the elephant in the room. I apologize for the lack of posts over the past few months. For the many who sent kind notes letting me know how much they enjoy the letter and hoping they will resume, I thank you. For those who have complained, I remind them that unsatisfied customers are entitled to full refund and to contact your MacroTourist national sales desk representative. But before you ask for your nil cheque, please be assured that I intend to return to my regular writing schedule and hopefully you will be more satisfied going forward.

Now, onto the fun market stuff!

I had planned to write about a boring economic topic, but with this weekend’s attack on Saudi Arabian energy assets, I interrupt regularly scheduled programming to address the topic on everyone’s lips.

No need to rehash the news. By now everyone is aware of the details.

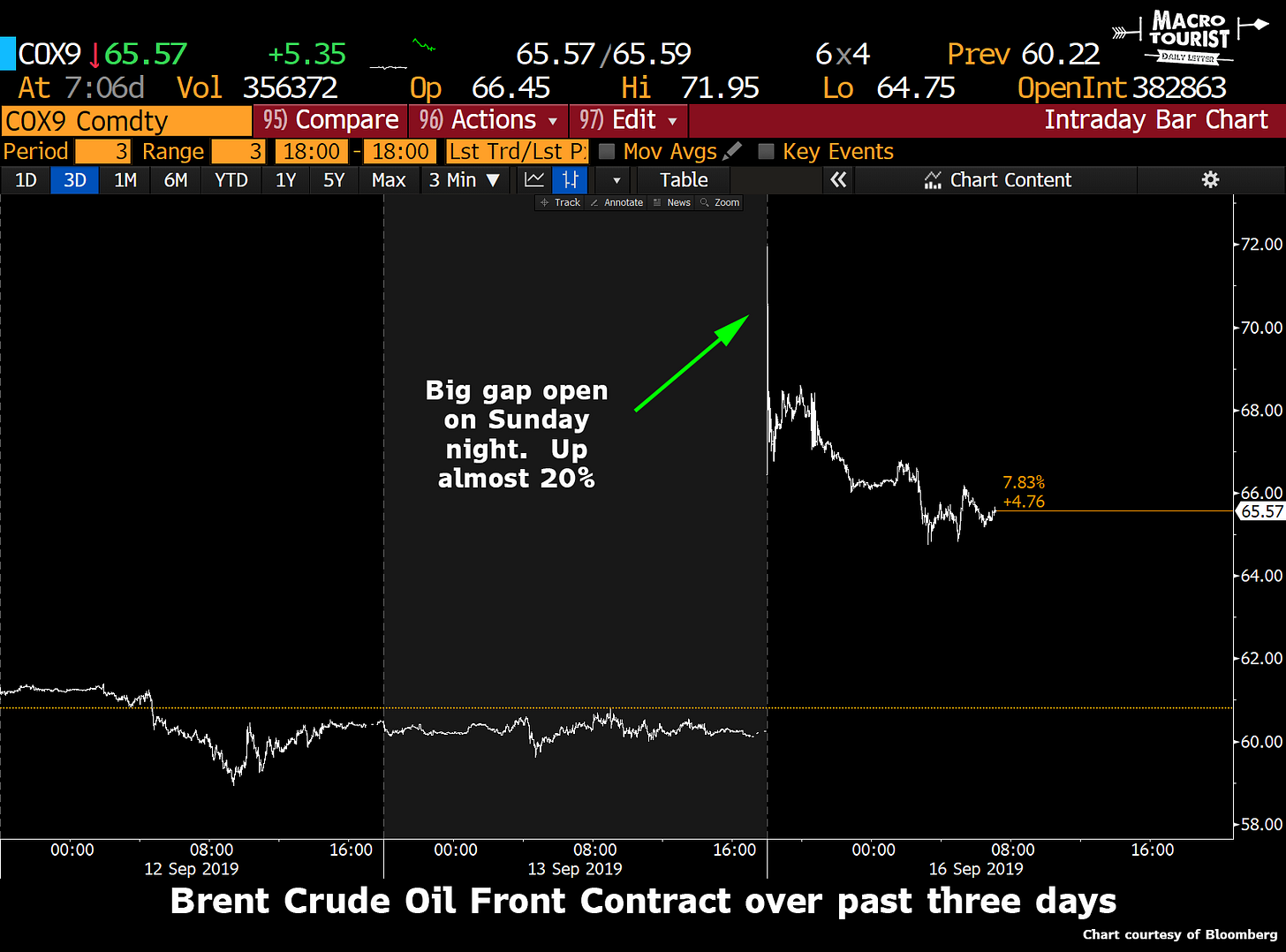

The development definitely caught the market flat-footed. Brent crude (which is more vulnerable to Saudi production shortfalls) gapped up almost $12 Sunday night.

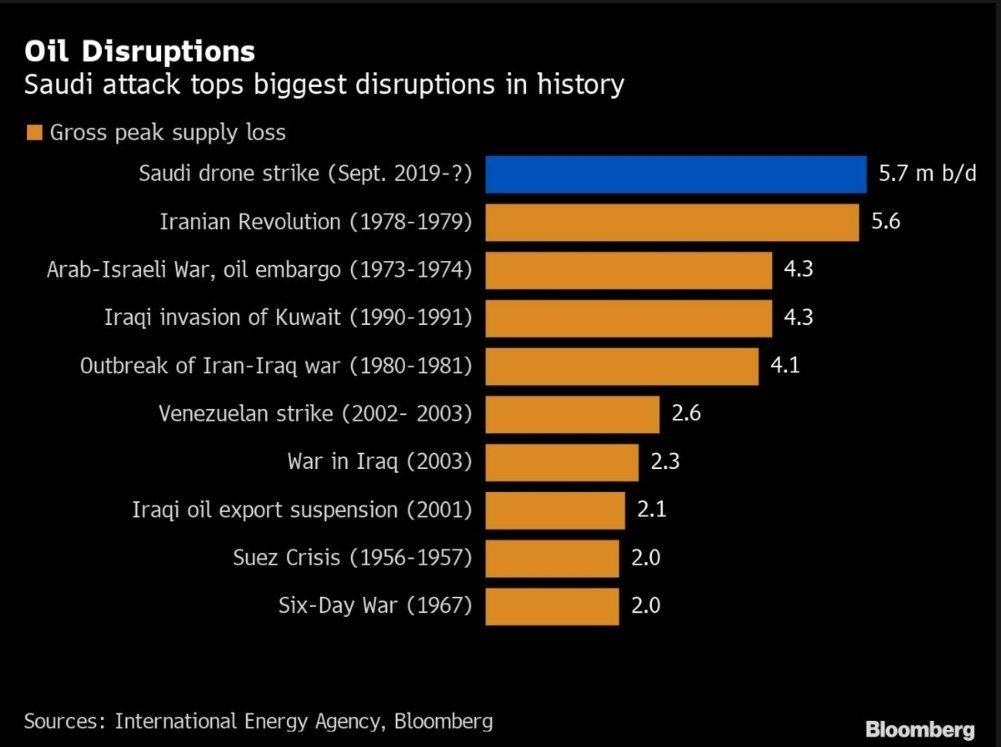

The new-found-oil-bulls were out in full force with all sorts of apocalyptic charts like this one:

Yeah, I get it. This is not a positive development, but let’s try to keep this in perspective. It’s not good, but neither is it the end of the world.

And before you accuse me of not appreciating the seriousness of the situation, I remind you that I have long worried about a Middle Eastern escalation. Here is quote from a May 24th, 2019 interview I gave on MacroVoices:

“One last thing I will leave you with Erik. Everyone is worried about the Chinese trade war, and although it’s not something that should be dismissed lightly, I contend it is more than fully in the price of all financial markets. But if I was looking for something to surprise markets, I would say it’s a real war or escalation of geopolitical tensions in the Mid-East. I am very concerned about the possibility that the Iran situation gets worse and that something happens in Saudi Arabia. So to me, if you were looking to hedge your portfolio, instead of going out and buying S&P puts, I think I would rather buy out-of-the-money crude oil calls.”

Although you might say I got this call right (even the blind squirrel finds an acorn now and then), I am unwilling to take a victory lap.

Let’s face it, crude oil is up 8% this morning, but it still hasn’t even busted through this spring’s $65 high - forget about last year’s $72.50 high tick.

We are still miles away from a true bull market in crude. Could that happen? For sure. But the fate of the energy market still lays in front of us. The bulls should temper their enthusiasm.

Yet I am by no means sanguine about the energy market. What am I worried about? I am concerned that a Saudi Arabian military response will cause a crude oil move that would be epic. I am not predicting that by any means, but the one thing I have learned over the decades is that markets can move way more than almost anyone can imagine.

This recent volatility is unusual given the last decade’s muted price action, but make no mistake, further escalation in the Middle-East will result in limit-up moves in crude oil futures.

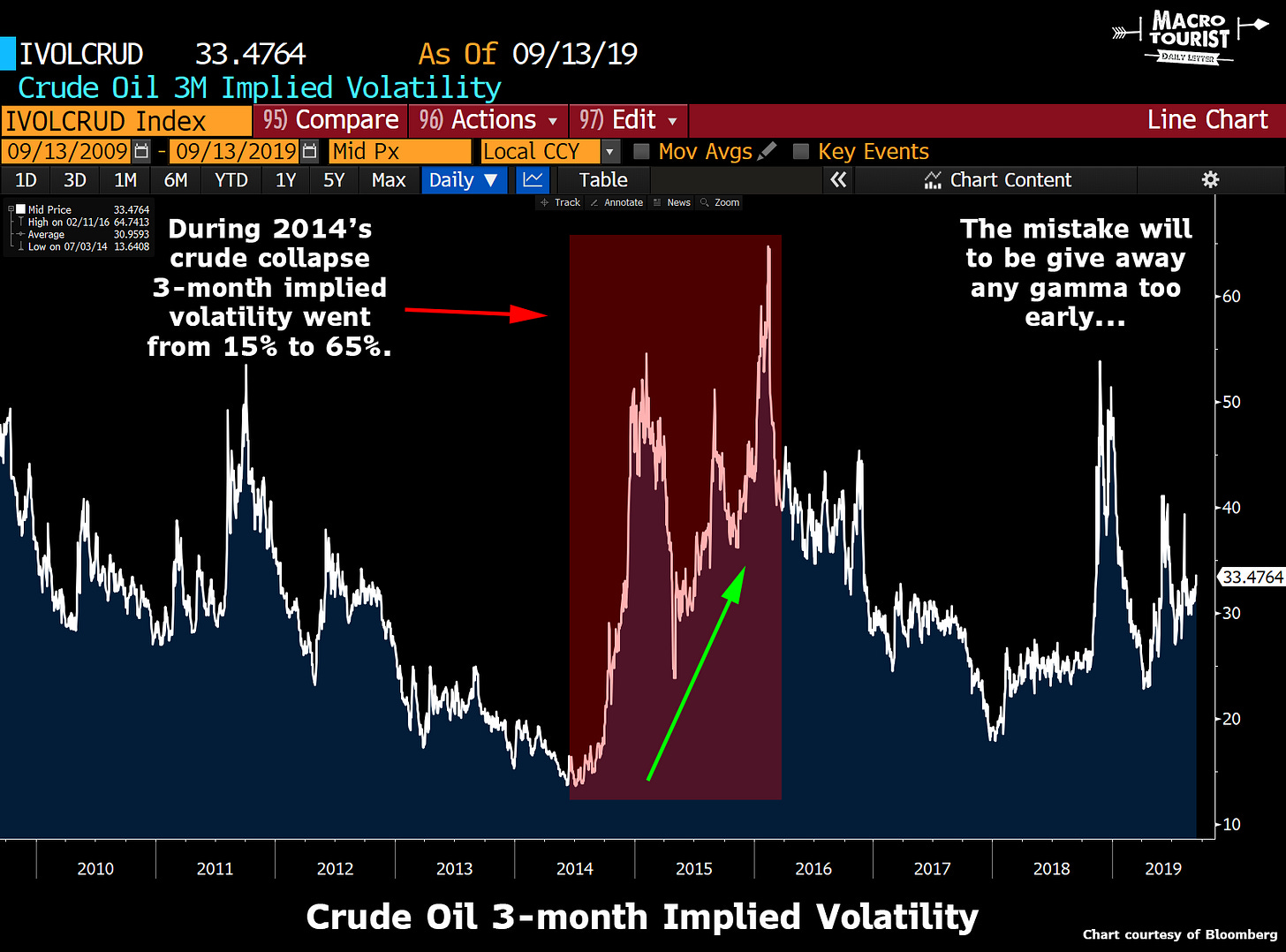

Although this morning when the crude oil futures pit opens, implied volatility will be bid, the error will be giving away any gamma too early.

The market is just starting to realize there is way more geopolitical risk than previously believed. This will not be priced in immediately and will take some time for participants to fully comprehend.

I am not sure about the direction of the next five buck move in oil, yet I am confident that implied volatility will not be collapsing anytime soon. And if it does, it’s probably an even better buy as geopolitical risks will once again be under appreciated.

There is no way I am paying up for vol this morning. It’s not my style to reach for it when everyone else is doing so. Yet I wouldn’t give away any long gamma exposure either, and if by later in the week oil has settled down, I would be on the gamma bid for crude.

Well, that’s it for today’s post. I just wanted to get one under my belt. Tomorrow I will discuss one of my favourite trades that will hopefully benefit from the rise in crude oil - long inflation breakevens.

Thanks for reading,

Kevin Muir